Time Magazine 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

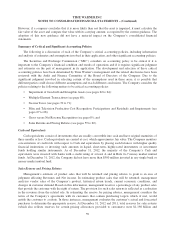

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

However, if a company concludes that it is more likely than not that the asset is impaired, it must calculate the

fair value of the asset and compare that value with its carrying amount, as required by the current guidance. The

adoption of this new guidance did not have a material impact on the Company’s consolidated financial

statements.

Summary of Critical and Significant Accounting Policies

The following is a discussion of each of the Company’s critical accounting policies, including information

and analysis of estimates and assumptions involved in their application, and other significant accounting policies.

The Securities and Exchange Commission (“SEC”) considers an accounting policy to be critical if it is

important to the Company’s financial condition and results of operations and if it requires significant judgment

and estimates on the part of management in its application. The development and selection of these critical

accounting policies have been determined by Time Warner’s management and the related disclosures have been

reviewed with the Audit and Finance Committee of the Board of Directors of the Company. Due to the

significant judgment involved in selecting certain of the assumptions used in these areas, it is possible that

different parties could choose different assumptions and reach different conclusions. The Company considers the

policies relating to the following matters to be critical accounting policies:

• Impairment of Goodwill and Intangible Assets (see pages 62 to 64);

• Multiple-Element Transactions (see page 68);

• Income Taxes (see pages 70 to 71);

• Film and Television Production Cost Recognition, Participations and Residuals and Impairments (see

pages 67 to 68);

• Gross versus Net Revenue Recognition (see page 69); and

• Sales Returns and Pricing Rebates (see pages 59 to 60).

Cash and Equivalents

Cash equivalents consist of investments that are readily convertible into cash and have original maturities of

three months or less. Cash equivalents are carried at cost, which approximates fair value. The Company monitors

concentrations of credit risk with respect to Cash and equivalents by placing such balances with higher quality

financial institutions or investing such amounts in liquid, short-term, highly-rated instruments or investment

funds holding similar instruments. As of December 31, 2012, the majority of the Company’s Cash and

equivalents were invested with banks with a credit rating of at least A and in Rule 2a-7 money market mutual

funds. At December 31, 2012, the Company did not have more than $500 million invested in any single bank or

money market mutual fund.

Sales Returns and Pricing Rebates

Management’s estimate of product sales that will be returned and pricing rebates to grant is an area of

judgment affecting Revenues and Net income. In estimating product sales that will be returned, management

analyzes vendor sales of the Company’s product, historical return trends, current economic conditions, and

changes in customer demand. Based on this information, management reserves a percentage of any product sales

that provide the customer with the right of return. The provision for such sales returns is reflected as a reduction

in the revenues from the related sale. In estimating the reserve for pricing rebates, management considers the

terms of the Company’s agreements with its customers that contain purchasing targets which, if met, would

entitle the customer to a rebate. In those instances, management evaluates the customer’s actual and forecasted

purchases to determine the appropriate reserve. At December 31, 2012 and 2011, total reserves for sales returns

(which also reflects reserves for certain pricing allowances provided to customers) were $1.198 billion and

59