Time Magazine 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

RESULTS OF OPERATIONS

Recent Accounting Guidance

See Note 1, “Description of Business, Basis of Presentation and Summary of Significant Accounting

Policies,” to the accompanying consolidated financial statements for a discussion of recent accounting guidance

adopted.

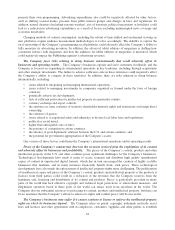

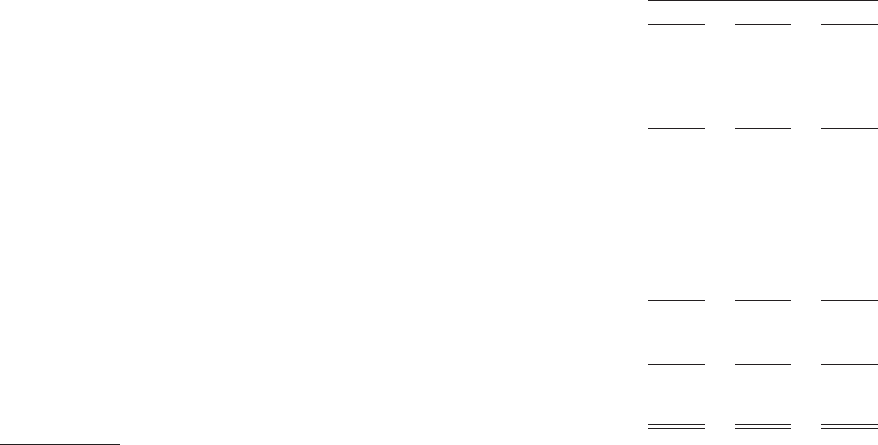

Transactions and Other Items Affecting Comparability

As more fully described herein and in the related notes to the accompanying consolidated financial

statements, the comparability of Time Warner’s results has been affected by transactions and certain other items

in each period as follows (millions):

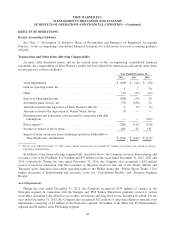

Year Ended December 31,

2012 2011 2010

Asset impairments ........................................... $ (186) $ (44) $ (20)

Gain on operating assets, net ................................... 9770

Other ..................................................... (31) (22) (22)

Impact on Operating Income ................................... (208) (59) 28

Investment gains (losses), net .................................. (73) (168) 32

Amounts related to the separation of Time Warner Cable Inc. ......... 4 (5) (6)

Amounts related to the disposition of Warner Music Group .......... (7) — —

Premiums paid and transaction costs incurred in connection with debt

redemptions .............................................. — — (364)

Pretax impact(a) ............................................. (284) (232) (310)

Income tax impact of above items ............................... 100 43 131

Impact of items on income from continuing operations attributable to

Time Warner Inc. shareholders ............................... $ (184) $ (189) $ (179)

(a) For the year ended December 31, 2010, pretax impact amount does not include $23 million of external costs related to mergers,

acquisitions or dispositions.

In addition to the items affecting comparability described above, the Company incurred Restructuring and

severance costs of $119 million, $113 million and $97 million for the years ended December 31, 2012, 2011 and

2010, respectively. During the year ended December 31, 2010, the Company also recognized a $58 million

reserve reversal in connection with the resolution of litigation related to the sale of the Atlanta Hawks and

Thrashers sports franchises and certain operating rights to the Philips Arena (the “Winter Sports Teams”). For

further discussion of Restructuring and severance costs, see “Consolidated Results” and “Business Segment

Results.”

Asset Impairments

During the year ended December 31, 2012, the Company recognized $174 million of charges at the

Networks segment in connection with the Imagine and TNT Turkey Shutdowns primarily related to certain

receivables, including value added tax receivables, inventories and long-lived assets, including Goodwill. For the

year ended December 31, 2012, the Company also recognized $12 million of other miscellaneous noncash asset

impairments consisting of $2 million at the Networks segment, $4 million at the Film and TV Entertainment

segment and $6 million at the Publishing segment.

28