Time Magazine 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

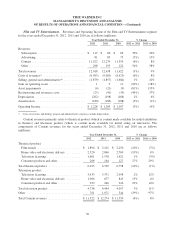

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

During the fourth quarter of 2010, Turner assumed management of the SI.com and Golf.com websites,

including selling the advertising for the websites, from Time Inc. In exchange, Time Inc. received a license fee

from Turner. In the second quarter of 2012, Time Inc. assumed management of these websites from Turner and,

with the transfer, Time Inc. now sells the advertising for these websites and no longer receives a license fee from

Turner. These changes did not affect the Company’s consolidated results of operations for the years ended

December 31, 2012, 2011 and 2010.

Recent Developments

Common Stock Repurchase Program

In January 2013, Time Warner’s Board of Directors authorized up to $4.0 billion of share repurchases

beginning January 1, 2013, including amounts available under the Company’s prior stock repurchase program as

of December 31, 2012. See “Financial Condition and Liquidity — Current Financial Condition” for more

information.

Revolving Credit Facility Maturity Date Extension

In 2012, the Company amended one of its $2.5 billion senior unsecured revolving credit facilities to extend

the maturity date from September 27, 2015 to December 14, 2017. The maturity date of Time Warner’s other

$2.5 billion senior unsecured revolving credit facility was not affected and remains September 27, 2016. See

“Financial Condition and Liquidity — Outstanding Debt and Other Financing Arrangements” for more

information.

Bleacher Report

In 2012, Turner acquired Bleacher Report, a leading online and mobile sports property, for $170 million, net

of cash acquired. See Note 3, “Business Acquisitions and Dispositions,” to the accompanying consolidated

financial statements.

2012 Debt Offering

In 2012, Time Warner issued $1.0 billion aggregate principal amount of debt securities in a public offering.

See “Financial Condition and Liquidity — Outstanding Debt and Other Financing Arrangements” for more

information.

CME

In 2012, the Company purchased additional shares of Class A common stock and one share of preferred

stock that is convertible into Class A common stock of Central European Media Enterprises Ltd. (“CME”), a

publicly traded media and entertainment company that operates leading television networks in six Central and

Eastern European countries, for $171 million. As a result of these purchases, the Company increased its

economic interest in CME from 34% to 49.9%. In 2012, the Company recorded a $43 million noncash

impairment of its investment in CME. For additional information regarding the transactions with CME, see

Note 3, “Business Acquisitions and Dispositions,” to the accompanying consolidated financial statements.

27