Time Magazine 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

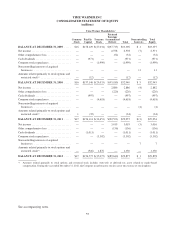

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

production costs denominated in foreign currencies as well as other transactions, assets and liabilities

denominated in foreign currencies. As part of its overall strategy to manage the level of exposure to the risk of

foreign currency exchange rate fluctuations, Time Warner hedges a portion of its foreign currency exposures

anticipated over a rolling twelve-month period. The hedging period for royalties and license fees covers revenues

expected to be recognized during the calendar year; however, there is often a lag between the time that revenue is

recognized and the transfer of foreign-denominated cash to U.S. dollars. To hedge this exposure, Time Warner

principally uses foreign exchange contracts that generally have maturities of three months to eighteen months

and provide continuing coverage throughout the hedging period. At December 31, 2012 and 2011, Time Warner

had contracts for the sale and the purchase of foreign currencies at fixed rates as summarized below by currency

(millions):

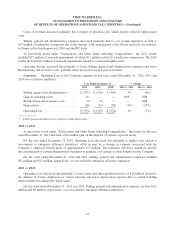

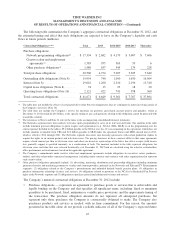

December 31, 2012 December 31, 2011

Sales Purchases Sales Purchases

British pound .................................. $ 701 $ 425 $ 915 $ 594

Euro ......................................... 371 426 525 434

Canadian dollar ................................ 692 425 771 548

Australian dollar ................................ 485 269 676 474

Other ........................................ 718 244 656 530

Total ......................................... $ 2,967 $ 1,789 $ 3,543 $ 2,580

Based on the foreign exchange contracts outstanding at December 31, 2012, a 10% devaluation of the

U.S. dollar as compared to the level of foreign exchange rates for currencies under contract at December 31,

2012 would result in a decrease of approximately $118 million in the value of such contracts. Conversely, a 10%

appreciation of the U.S. dollar would result in an increase of approximately $118 million in the value of such

contracts. For a hedge of forecasted royalty or license fees denominated in a foreign currency, consistent with the

nature of the economic hedge provided by such foreign exchange contracts, unrealized gains or losses largely

would be offset by corresponding decreases or increases, respectively, in the dollar value of future foreign

currency royalty and license fee payments. See Note 7, “Derivative Instruments,” to the accompanying

consolidated financial statements for additional information.

Equity Risk

The Company is exposed to market risk as it relates to changes in the market value of its investments. The

Company invests in equity instruments of public and private companies for operational and strategic business

purposes. These securities are subject to significant fluctuations in fair market value due to the volatility of the

stock markets and the industries in which the companies operate. At December 31, 2012 and 2011, these

securities, which are classified in Investments, including available-for-sale securities in the accompanying

Consolidated Balance Sheet, included $931 million and $939 million, respectively, of investments accounted for

using the equity method of accounting, $390 million and $204 million, respectively, of cost-method investments,

$609 million and $591 million, respectively, of investments related to the Company’s deferred compensation

program and $117 million and $86 million, respectively, of investments in available-for-sale securities.

The potential loss in fair value resulting from a 10% adverse change in the prices of the Company’s equity-

method investments, cost-method investments and available-for-sale securities would be approximately

$145 million. The potential loss in fair value resulting from a 10% adverse change in the prices of the certain of

the Company’s deferred compensation investments accounted for as trading securities would be approximately

$25 million. While Time Warner has recognized all declines that are believed to be other-than-temporary, it is

50