Time Magazine 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

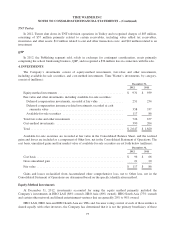

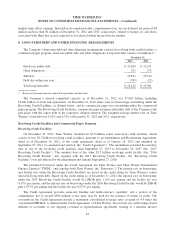

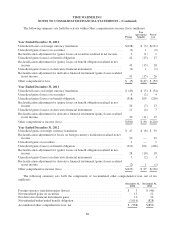

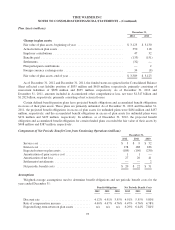

Significant components of Time Warner’s net deferred tax liabilities are as follows (millions):

December 31,

2012 2011

Deferred tax assets:

Tax attribute carryforwards(a) ......................................... $ 835 $ 889

Receivable allowances and return reserves ............................... 244 274

Royalties, participations and residuals .................................. 474 438

Investments ....................................................... 170 188

Equity-based compensation ........................................... 280 443

Amortization and depreciation ........................................ 373 130

Other ............................................................ 1,087 1,131

Valuation allowances(a) .............................................. (560) (640)

Total deferred tax assets ............................................. $ 2,903 $ 2,853

Deferred tax liabilities:

Assets acquired in business combinations ................................ $ 3,521 $ 3,641

Unbilled television receivables ........................................ 915 939

Unremitted earnings of foreign subsidiaries .............................. 120 151

Total deferred tax liabilities ........................................... 4,556 4,731

Net deferred tax liability ............................................. $ 1,653 $ 1,878

(a) The Company has recorded valuation allowances for certain tax attribute carryforwards and other deferred tax assets due to uncertainty

that exists regarding future realizability. The tax attribute carryforwards consist of $315 million of tax credits, $240 million of capital

losses and $280 million of net operating losses that expire in varying amounts from 2013 through 2032. If, in the future, the Company

believes that it is more likely than not that these deferred tax benefits will be realized, the majority of the valuation allowances will be

recognized in the Consolidated Statement of Operations.

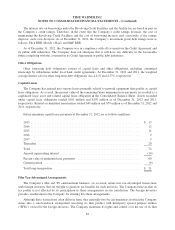

U.S. income and foreign withholding taxes have not been recorded on permanently reinvested earnings of

certain foreign subsidiaries aggregating approximately $1.9 billion at December 31, 2012. Determination of the

amount of unrecognized deferred U.S. income tax liability with respect to such earnings is not practicable.

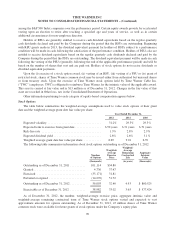

For accounting purposes, the Company records equity-based compensation expense and a related deferred

tax asset for the future tax deductions it may receive. For income tax purposes, the Company receives a tax

deduction equal to the stock price on the date that a restricted stock unit (or performance share unit) vests or the

excess of the stock price over the exercise price of an option upon exercise. The deferred tax asset consists of

amounts relating to individual unvested and/or unexercised equity-based compensation awards; accordingly,

deferred tax assets related to certain equity awards may currently be in excess of the tax benefit ultimately

received. The applicable accounting rules require that the deferred tax asset related to an equity-based

compensation award be reduced only at the time the award vests (in the case of a restricted stock unit or

performance share unit), is exercised (in the case of a stock option) or otherwise expires or is cancelled. This

reduction is recorded as an adjustment to additional paid-in capital (“APIC”), to the extent that the realization of

excess tax deductions on prior equity-based compensation awards were recorded directly to APIC. The

cumulative amount of such excess tax deductions is referred to as the Company’s “APIC Pool.” Any shortfall

balance recognized in excess of the Company’s APIC Pool is charged to Income tax provision in the

Consolidated Statement of Operations. The Company’s APIC Pool was sufficient to absorb any shortfalls such

that no shortfalls were charged to the Income tax provision during the years ended December 31, 2012, 2011 and

2010.

85