Time Magazine 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

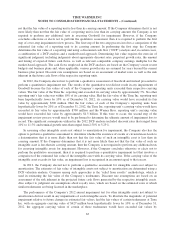

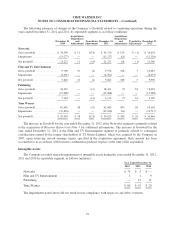

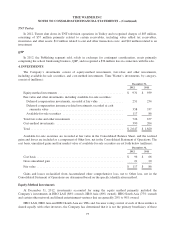

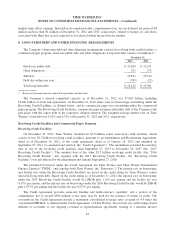

The Company’s intangible assets subject to amortization and related accumulated amortization consisted of

the following (millions):

December 31, 2012 December 31, 2011

Gross

Accumulated

Amortization(a) Net Gross

Accumulated

Amortization(a) Net

Intangible assets subject to amortization:

Film library ............................. $ 3,452 $(2,345) $ 1,107 $ 3,514 $(2,194) $ 1,320

Brands, tradenames and other

intangible assets(b) ...................... 2,145 (1,144) 1,001 2,015 (1,103) 912

Total .................................. $ 5,597 $(3,489) $ 2,108 $ 5,529 $(3,297) $ 2,232

(a) The film library is amortized using a film forecast methodology. Amortization of brands, tradenames and other intangible assets subject

to amortization is provided generally on a straight-line basis over their respective useful lives.

(b) Effective December 31, 2012, certain tradenames of the Publishing segment totaling approximately $164 million that were previously

assigned indefinite lives have been assigned finite lives of 18 years and will begin to be amortized starting in January 2013.

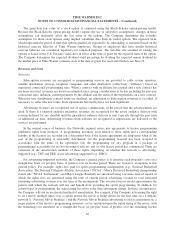

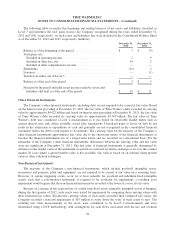

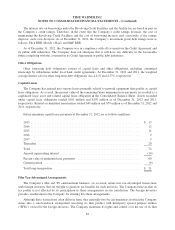

The Company recorded amortization expense of $248 million in 2012 compared to $269 million in 2011 and

$264 million in 2010. The Company estimates amortization expense for future years based on the amount of

intangible assets subject to amortization at December 31, 2012. These amounts may vary as acquisitions and

dispositions occur in the future and as purchase price allocations are finalized. The Company’s estimated

amortization expense for the succeeding five years ended December 31 is as follows (millions):

2013 2014 2015 2016 2017

Estimated amortization expense ............. $ 242 $ 230 $ 217 $ 212 $204

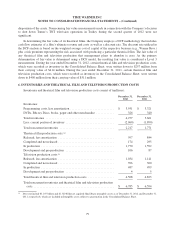

3. BUSINESS ACQUISITIONS AND DISPOSITIONS

Acquisitions

Bleacher Report

In 2012, Turner Broadcasting System, Inc. (“Turner”) acquired Bleacher Report, a leading online and mobile

sports property, for $170 million, net of cash acquired. The operating results of Bleacher Report did not

significantly impact the Company’s consolidated financial results for the year ended December 31, 2012.

CME

Central European Media Enterprises Ltd. (“CME”) is a publicly-traded broadcasting company operating

leading networks in six Central and Eastern European countries. On May 18, 2009, the Company completed an

equity investment in CME for $246 million. In the first quarter of 2011, the Company completed an additional

equity investment in CME for $61 million. In connection with its investment, Time Warner agreed to allow CME

founder and Non-Executive Chairman Ronald S. Lauder to vote Time Warner’s shares of CME until at least May

2013, subject to certain exceptions. The Company’s investment in CME is being accounted for under the cost

method of accounting. Upon the expiration of the voting agreement with Ronald S. Lauder in May 2013, the

Company expects to begin accounting for its investment in CME under the equity method of accounting. In the

fourth quarter of 2011, the Company recorded a $163 million noncash impairment related to its investment in

CME.

On April 30, 2012, the Company and CME entered into an arrangement in which the Company agreed to

purchase shares of CME’s Class A common stock and to loan CME up to $300 million for the sole purpose of

CME retiring certain of its outstanding public indebtedness that was scheduled to mature over the next few years

through concurrent tender offers (the “CME Credit Facility”). The arrangement also gave CME the option to sell

the Company additional shares of CME’s Class A common stock or securities convertible into Class A common

73