Time Magazine 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

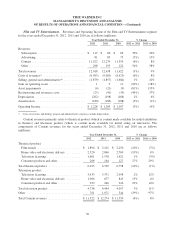

The Film and TV Entertainment segment’s theatrical product revenues are generated principally through

rental fees from theatrical exhibition of feature films, including the following films: Argo,The Campaign,The

Dark Knight Rises,The Hobbit: An Unexpected Journey,Journey 2: The Mysterious Island,Magic Mike and

Wrath of the Titans, and subsequently through licensing fees received from the distribution of films on television

networks and pay television programming services. Television product revenues are generated principally from

the licensing of programs to television networks and pay television programming services. The segment also

generates revenues for both its theatrical and television product through home video distribution on DVD and

Blu-ray Discs and in various digital formats (e.g., EST and video-on-demand) as well as through licensing of

feature films and television programming to broadband subscription video-on-demand services (“SVOD”). In

addition, the segment generates revenues through the development and distribution of videogames.

Warner Bros. continues to be an industry leader in the television content business. For the 2012-2013 season,

Warner Bros. produced more than 50 series, with at least two series for each of the five broadcast networks

(including 2 Broke Girls,Arrow,The Bachelor,The Big Bang Theory,Fringe,The Mentalist,The Middle,

Mike & Molly,Person of Interest,Two and a Half Men,Vampire Diaries and The Voice), several original series

for cable television networks (including Dallas,Longmire, Major Crimes,Pretty Little Liars and Rizzoli & Isles)

and several series for first-run syndication (including The Ellen DeGeneres Show,Extra and TMZ).

Internationally, Warner Bros. operates a group of local television production companies in the U.K. and the

Netherlands that focus on developing non-scripted programs and formats that can be sold internationally and

adapted for sale in the U.S. Warner Bros. has also begun to create locally produced versions of programs owned

by the studio as well as original local television programming.

The distribution and sale of physical discs (both standard definition DVDs and high definition Blu-ray Discs)

has been one of the largest contributors to the segment’s revenues and profits over the last decade. However, in

recent years, home video revenues have declined as a result of several factors, including consumers shifting

to subscription rental services and discount rental kiosks, which generate significantly less revenue per

transaction for the Company than physical disc sales; the general economic downturn in the U.S. and many

regions around the world; increasing competition for consumer discretionary time and spending; and piracy. The

electronic delivery of film and television content is growing and becoming more important to the Film and TV

Entertainment segment, which has helped to offset some, but not all, of the decline in sales of physical discs. In

2012, the decline in consumer spending on physical discs moderated compared to prior years, while the growth in

consumer spending on electronic delivery increased.

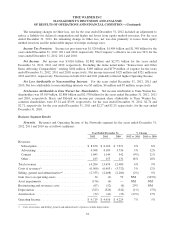

Publishing. Time Warner’s Publishing segment consists principally of Time Inc.’s magazine publishing

and related websites as well as book publishing and marketing businesses. During the year ended December 31,

2012, the Publishing segment recorded Revenues of $3.436 billion (12% of the Company’s total Revenues) and

$420 million in Operating Income.

As of December 31, 2012, Time Inc. published 21 magazines in print in the U.S., including People,Sports

Illustrated,InStyle and Time, and over 70 magazines outside the U.S. All of Time Inc.’s U.S. magazines are

available as tablet editions on multiple digital devices and platforms. The Publishing segment generates revenues

primarily from the sale of advertising, magazine subscriptions and newsstand sales. The Publishing segment is

experiencing declines in its print advertising and newsstand sales as a result of market conditions in the magazine

publishing industry as well as the current economic environment in the U.S. and internationally. The Publishing

segment is pursuing a number of initiatives to help mitigate these declines, including conducting additional brand

marketing; developing innovative ways to sell branded magazine content outside of traditional channels,

including websites, tablets and other mobile devices; developing integrated advertising solutions that will provide

greater data insight and value to advertisers; developing a new cross-platform content management system; and

improving its operating efficiency through management of its cost structure.

26