Time Magazine 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

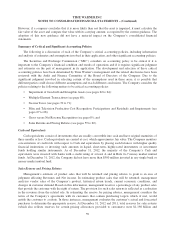

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

decisions about the entity’s operations or (iii) the voting rights of some investors are not proportional to their

obligations to absorb the expected losses of the entity or receive the expected returns of the entity and

substantially all of the entity’s activities involve or are conducted on behalf of the investor with

disproportionately few voting rights. Time Warner periodically makes judgments in determining whether entities

in which it invests are VIEs and, each reporting period, the Company assesses whether it is the primary

beneficiary in any of its VIEs. Entities determined to be VIEs primarily consist of the Company’s investments in

HBO Asia, HBO South Asia and HBO Latin America Group (“HBO LAG”) because the Company’s ownership

and voting rights in these entities are disproportionate. These entities operate multi-channel premium pay and

basic tier television services and are accounted for using the equity method. See Note 4 for additional

information.

Derivative Instruments

The Company uses derivative instruments principally to manage the risk associated with movements in

foreign currency exchange rates and recognizes all derivative instruments on the Consolidated Balance Sheet at

fair value. Changes in fair value of derivative instruments that qualify for hedge accounting will either be offset

against the change in fair value of the hedged assets, liabilities or firm commitments through earnings or

recognized in shareholders’ equity as a component of Accumulated other comprehensive loss, net, until the

hedged item is recognized in earnings, depending on whether the derivative instrument is being used to hedge

changes in fair value or cash flows. For qualifying hedge relationships, the Company excludes the impact of

forward points from its assessment of hedge effectiveness. The ineffective portion of a derivative instrument’s

change in fair value is immediately recognized in earnings. For those derivative instruments that do not qualify

for hedge accounting, changes in fair value are recognized immediately in earnings. See Note 7 for additional

information regarding derivative instruments held by the Company and risk management strategies.

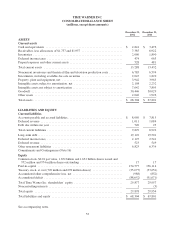

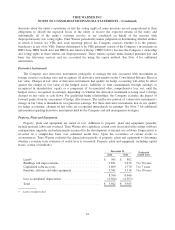

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Additions to property, plant and equipment generally

include material, labor and overhead. Time Warner also capitalizes certain costs associated with coding, software

configuration, upgrades and enhancements incurred for the development of internal use software. Depreciation is

recorded on a straight-line basis over estimated useful lives. Upon the occurrence of certain events or

circumstances, Time Warner evaluates the depreciation periods of property, plant and equipment to determine

whether a revision to its estimates of useful lives is warranted. Property, plant and equipment, including capital

leases, consist of (millions):

December 31, Estimated

Useful Lives2012 2011

Land(a) ............................................ $ 505 $ 502

Buildings and improvements .......................... 2,851 2,676 7 to 30 years

Capitalized software costs ............................. 1,869 1,770 3 to 7 years

Furniture, fixtures and other equipment .................. 3,541 3,518 3 to 10 years

8,766 8,466

Less accumulated depreciation ......................... (4,824) (4,503)

Total ............................................. $ 3,942 $ 3,963

(a) Land is not depreciated.

61