Time Magazine 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

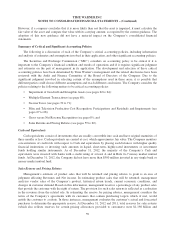

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The grant-date fair value of a stock option is estimated using the Black-Scholes option-pricing model.

Because the Black-Scholes option-pricing model requires the use of subjective assumptions, changes in these

assumptions can materially affect the fair value of the options. The Company determines the volatility

assumption for these stock options using implied volatilities data from its traded options. The expected term,

which represents the period of time that options granted are expected to be outstanding, is estimated based on the

historical exercise behavior of Time Warner employees. Groups of employees that have similar historical

exercise behavior are considered separately for valuation purposes. The risk-free rate assumed in valuing the

options is based on the U.S. Treasury yield curve in effect at the time of grant for the expected term of the option.

The Company determines the expected dividend yield percentage by dividing the expected annual dividend by

the market price of Time Warner common stock at the date of grant. For more information, see Note 12.

Revenues and Costs

Networks

Subscription revenues are recognized as programming services are provided to cable system operators,

satellite distribution services, telephone companies and other distributors (collectively, “affiliates”) based on

negotiated contractual programming rates. When a contract with an affiliate has expired and a new contract has

not been executed, revenues are based on estimated rates, giving consideration to factors including the previous

contractual rates, inflation, current payments by the affiliate and the status of the negotiations on a new contract.

When the new distribution contract terms are finalized, an adjustment to Subscription revenues is recorded, if

necessary, to reflect the new terms. Such adjustments historically have not been significant.

Advertising revenues are recognized, net of agency commissions, in the period that the advertisements are

aired. If there is a targeted audience guarantee, revenues are recognized for the actual audience delivery with

revenue deferred for any shortfall until the guaranteed audience delivery is met, typically through the provision

of additional air time. Advertising revenues from websites are recognized as impressions are delivered or the

services are performed.

In the normal course of business, the Networks segment enters into agreements to license programming

exhibition rights from licensors. A programming inventory asset related to these rights and a corresponding

liability to the licensor are recorded (on a discounted basis if the license agreements are long-term) when (i) the

cost of the programming is reasonably determined, (ii) the programming material has been accepted in

accordance with the terms of the agreement, (iii) the programming (or any program in a package of

programming) is available for its first showing or telecast, and (iv) the license period has commenced. There are

variations in the amortization methods of these rights, depending on whether the network is advertising-

supported (e.g., TNT and TBS) or not advertising-supported (e.g., HBO).

For advertising-supported networks, the Company’s general policy is to amortize each program’s costs on a

straight-line basis (or per-play basis, if greater) over its license period. There are, however, exceptions to this

general policy. For example, rights fees paid for sports programming arrangements (e.g., National Basketball

Association, The National Collegiate Athletic Association (“NCAA”) Men’s Division I Basketball championship

events (the “NCAA Tournament”) and Major League Baseball) are amortized using a revenue-forecast model, in

which the rights fees are amortized using the ratio of current period advertising revenue to total estimated

remaining advertising revenue over the term of the arrangement. The revenue-forecast model approximates the

pattern with which the network will use and benefit from providing the sports programming. In addition, for

certain types of programming, the initial airing has more value than subsequent airings. In these circumstances,

the Company will use an accelerated method of amortization. For example, if the Company is licensing the right

to air a movie multiple times over a certain period, the movie is being shown for the first time on a Company

network (a “Network Movie Premiere”) and the Network Movie Premiere advertising is sold at a premium rate, a

larger portion of the movie’s programming inventory cost is amortized upon the initial airing of the movie, with

the remaining cost amortized on a straight-line basis (or per-play basis, if greater) over the remaining license

65