Time Magazine 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

product. The Company evaluates these SPEs for consolidation in accordance with its policy. Because the

Company generally does not have a controlling interest in the SPEs, it generally does not consolidate them. In

addition, the Company does not guarantee and is not otherwise responsible for the equity and debt in these SPEs

and does not participate in the profits or losses of these SPEs. The Company accounts for these arrangements

based on their substance, and the Company records the costs of producing the films as an asset and records the

net benefit received from the investors as a reduction of film and television production costs resulting in lower

film and television production cost amortization for the films involved in the arrangement. At December 31,

2012, such SPEs were capitalized with approximately $3.1 billion of debt and equity from the third-party

investors. These transactions resulted in reductions of film and television production cost amortization totaling

$10 million, $34 million and $7 million during the years ended December 31, 2012, 2011 and 2010, respectively.

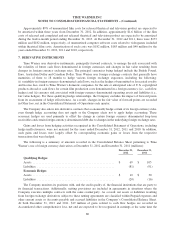

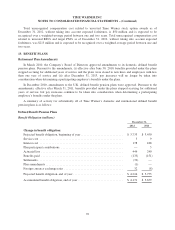

9. INCOME TAXES

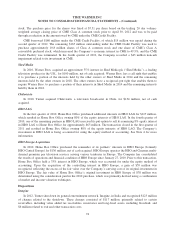

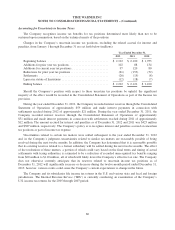

Domestic and foreign income before income taxes and discontinued operations are as follows (millions):

Year Ended December 31,

2012 2011 2010

Domestic ............................................... $ 4,445 $ 4,285 $ 3,575

Foreign ................................................. 97 81 344

Total ................................................... $ 4,542 $ 4,366 $ 3,919

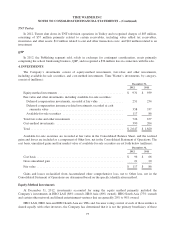

Current and Deferred income taxes (tax benefits) provided on Income from continuing operations are as

follows (millions):

Year Ended December 31,

2012 2011 2010

Federal:

Current ............................................... $ 1,195 $ 922 $ 764

Deferred .............................................. (135) 178 84

Foreign:

Current(a) .............................................. 358 364 375

Deferred .............................................. 4 (52) (23)

State and Local:

Current ............................................... 123 63 120

Deferred .............................................. (19) 9 28

Total ................................................. $ 1,526 $ 1,484 $ 1,348

(a) Includes foreign withholding taxes of $245 million in 2012, $244 million in 2011 and $226 million in 2010.

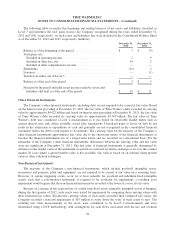

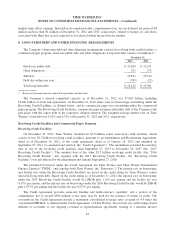

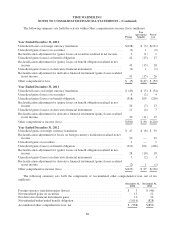

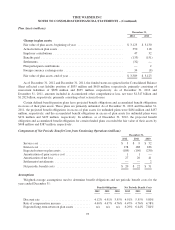

The differences between income taxes expected at the U.S. federal statutory income tax rate of 35% and

income taxes provided are as set forth below (millions):

Year Ended December 31,

2012 2011 2010

Taxes on income at U.S. federal statutory rate ................... $ 1,590 $ 1,528 $ 1,372

State and local taxes, net of federal tax effects .................. 65 71 73

Domestic production activities deduction ...................... (160) (123) (96)

Other ................................................... 31 8 (1)

Total ................................................... $ 1,526 $ 1,484 $ 1,348

84