Time Magazine 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

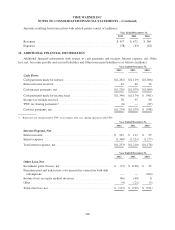

TIME WARNER INC.

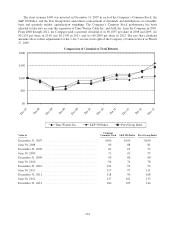

SELECTED FINANCIAL INFORMATION

The selected financial information set forth below for each of the three years in the period ended December 31,

2012 has been derived from and should be read in conjunction with the audited financial statements and other

financial information presented elsewhere herein. The selected financial information set forth below for the years

ended December 31, 2009 and December 31, 2008 has been derived from audited financial statements not included

herein. Capitalized terms are as defined and described in the consolidated financial statements or elsewhere herein.

Certain reclassifications have been made to conform to the 2012 presentation.

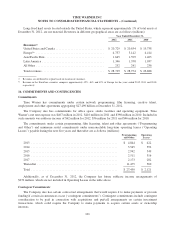

Year Ended December 31,

2012 2011 2010 2009 2008(a)

(millions, except per share amounts)

Selected Operating Statement Information:

Total revenues ............................... $ 28,729 $ 28,974 $ 26,888 $ 25,388 $ 26,434

Operating income (loss) ........................ 5,918 5,805 5,428 4,470 (3,044)

Net income (loss) ............................. 3,016 2,882 2,571 2,512 (14,649)

Amounts attributable to Time Warner Inc.

shareholders:

Income (loss) from continuing operations .......... $ 3,019 $ 2,886 $ 2,578 $ 2,088 $ (5,090)

Discontinued operations, net of tax ...............———389(8,308)

Net income (loss) ............................. $ 3,019 $ 2,886 $ 2,578 $ 2,477 $ (13,398)

Per share information attributable to

Time Warner Inc. common shareholders:

Basic income (loss) per common share from

continuing operations ........................ $ 3.14 $ 2.74 $ 2.27 $ 1.76 $ (4.27)

Discontinued operations ........................———0.32 (6.95)

Basic net income (loss) per common share ......... $ 3.14 $ 2.74 $ 2.27 $ 2.08 $ (11.22)

Diluted income (loss) per common share from

continuing operations ........................ $ 3.09 $ 2.71 $ 2.25 $ 1.75 $ (4.27)

Discontinued operations ........................———0.32 (6.95)

Diluted net income (loss) per common share ........ $ 3.09 $ 2.71 $ 2.25 $ 2.07 $ (11.22)

Average common shares:

Basic ..................................... 954.4 1,046.2 1,128.4 1,184.0 1,194.2

Diluted ................................... 976.3 1,064.5 1,145.3 1,195.1 1,194.2

Selected Balance Sheet Information:

Cash and equivalents .......................... $ 2,841 $ 3,476 $ 3,663 $ 4,733 $ 1,082

Total assets .................................. 68,304 67,801 66,707 66,207 114,577

Debt due within one year ....................... 749 23 26 57 2,041

Non-recourse debt ............................———805805

Long-term debt ............................... 19,122 19,501 16,523 15,346 19,855

Time Warner Inc. shareholders’ equity ............ 29,877 29,957 32,940 33,396 42,292

Total capitalization at book value ................ 49,748 49,481 49,489 49,604 64,993

Cash dividends declared per share of common

stock ..................................... 1.04 0.94 0.85 0.75 0.75

(a) 2008 includes a $7.139 billion noncash impairment to reduce the carrying value of goodwill and intangible assets at the Publishing

segment. Total assets, Time Warner Inc. shareholder’s equity and Total capitalization at book value for 2008 include amounts related to

discontinued operations, primarily related to Time Warner Cable Inc. and AOL Inc.

111