Time Magazine 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

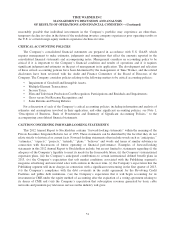

Outstanding Debt and Other Financing Arrangements

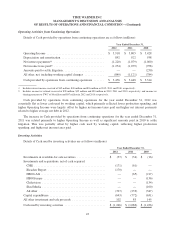

Outstanding Debt and Committed Financial Capacity

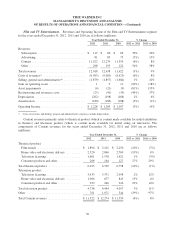

At December 31, 2012, Time Warner had total committed capacity, defined as maximum available

borrowings under various existing debt arrangements and cash and short-term investments, of $27.803 billion. Of

this committed capacity, $7.863 billion was unused and $19.871 billion was outstanding as debt. At

December 31, 2012, total committed capacity, outstanding letters of credit, outstanding debt and total unused

committed capacity were as follows (millions):

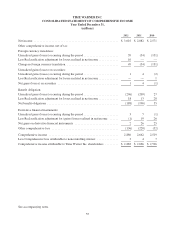

Committed

Capacity(a)

Letters of

Credit(b)

Outstanding

Debt(c)

Unused

Committed

Capacity

Cash and equivalents ................................... $ 2,841 $ — $ — $ 2,841

Revolving credit facilities and commercial paper program(d) .... 5,000 2 — 4,998

Fixed-rate public debt .................................. 19,620 — 19,620 —

Other obligations(e) ..................................... 342 67 251 24

Total ................................................ $ 27,803 $ 69 $ 19,871 $ 7,863

(a) The revolving credit facilities, commercial paper program and public debt of the Company rank pari passu with the senior debt of the

respective obligors thereon. The weighted average maturity of the Company’s outstanding debt and other financing arrangements was

14.4 years as of December 31, 2012.

(b) Represents the portion of committed capacity, including from bilateral letter of credit facilities, reserved for outstanding and undrawn

letters of credit.

(c) Represents principal amounts adjusted for premiums and discounts. At December 31, 2012, the principal amounts of the Company’s

public debt matures as follows: $732 million in 2013 (classified as current on the accompanying Consolidated Balance Sheet at

December 31, 2012), $0 in 2014, $1.000 billion in 2015, $1.150 billion in 2016, $500 million in 2017 and $16.381 billion thereafter. In

the period after 2017, no more than $2.0 billion will mature in any given year.

(d) The revolving credit facilities consist of two $2.5 billion revolving credit facilities. The Company may issue unsecured commercial paper

notes up to the amount of the unused committed capacity under the revolving credit facilities.

(e) Unused committed capacity includes committed financings of subsidiaries under local bank credit agreements. Other debt obligations

totaling $17 million are due within the next twelve months.

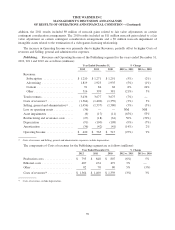

2012 Debt Offering

On June 13, 2012, Time Warner issued $1.0 billion aggregate principal amount of debt securities from its

shelf registration statement, consisting of $500 million aggregate principal amount of 3.40% Notes due 2022 and

$500 million aggregate principal amount of 4.90% Debentures due 2042.

Revolving Credit Facilities

On December 14, 2012, Time Warner amended its $5.0 billion senior unsecured credit facilities (the

“Revolving Credit Facilities”), which consist of two $2.5 billion revolving credit facilities. The amendment

extended the maturity date of one of the revolving credit facilities from September 27, 2015 to December 14,

2017. The maturity date of the other revolving credit facility was not affected by the amendment and remains

September 27, 2016.

The funding commitments under the Revolving Credit Facilities are provided by a geographically diverse

group of 20 major financial institutions based in countries including Canada, France, Germany, Japan, Spain,

Switzerland, the United Kingdom and the U.S. In addition, 19 of these financial institutions have been identified

by international regulators as among the 29 financial institutions that they deem to be systemically important.

None of the financial institutions in the Revolving Credit Facilities accounts for more than 7% of the aggregate

undrawn loan commitments.

45