Time Magazine 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

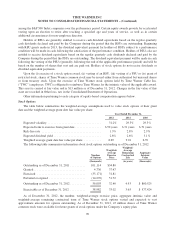

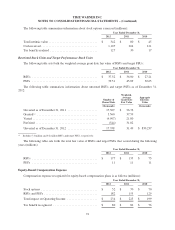

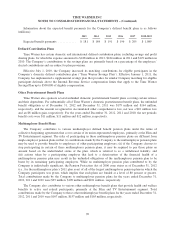

Total unrecognized compensation cost related to unvested Time Warner stock option awards as of

December 31, 2012, without taking into account expected forfeitures, is $50 million and is expected to be

recognized over a weighted-average period between one and two years. Total unrecognized compensation cost

related to unvested RSUs and target PSUs as of December 31, 2012, without taking into account expected

forfeitures, was $213 million and is expected to be recognized over a weighted-average period between one and

two years.

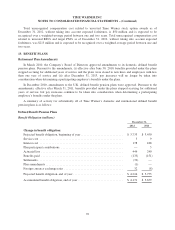

13. BENEFIT PLANS

Retirement Plan Amendments

In March 2010, the Company’s Board of Directors approved amendments to its domestic defined benefit

pension plans. Pursuant to the amendments, (i) effective after June 30, 2010, benefits provided under the plans

stopped accruing for additional years of service and the plans were closed to new hires and employees with less

than one year of service and (ii) after December 31, 2013, pay increases will no longer be taken into

consideration when determining a participating employee’s benefits under the plans.

In December 2010, amendments to the U.K. defined benefit pension plans were approved. Pursuant to the

amendments, effective after March 31, 2011, benefits provided under the plans stopped accruing for additional

years of service, but pay increases continue to be taken into consideration when determining a participating

employee’s benefits under the plans.

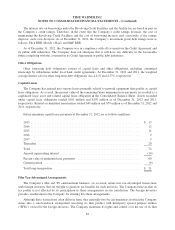

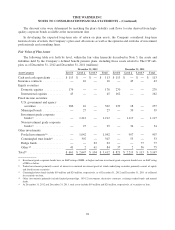

A summary of activity for substantially all of Time Warner’s domestic and international defined benefit

pension plans is as follows:

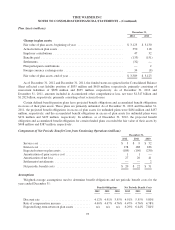

Defined Benefit Pension Plans

Benefit Obligation (millions)

December 31,

2012 2011

Change in benefit obligation:

Projected benefit obligation, beginning of year ............................ $ 3,733 $ 3,450

Service cost ....................................................... 3 9

Interest cost ....................................................... 178 188

Plan participant contributions ......................................... — 5

Actuarial loss ...................................................... 444 240

Benefits paid ...................................................... (133) (151)

Settlements ........................................................ (32) —

Plan amendments ................................................... (1) —

Foreign currency exchange rates ....................................... 32 (8)

Projected benefit obligation, end of year ................................. $ 4,224 $ 3,733

Accumulated benefit obligation, end of year .............................. $ 4,171 $ 3,659

92