Saks Fifth Avenue 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

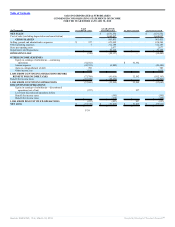

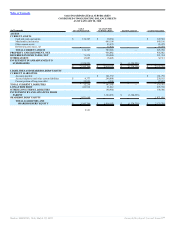

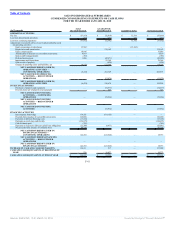

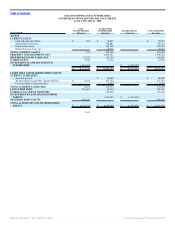

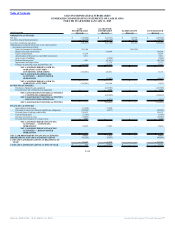

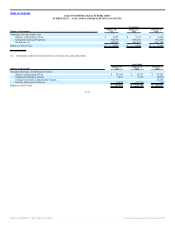

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

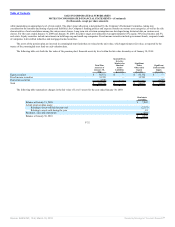

Statements of Income by adjusting Net Sales and SG&A to reflect all shipping and handling revenue in Net Sales. The adjustment for the quarterly periods ended

August 1, 2009, May 2, 2009, January 31, 2009, November 1, 2008, August 2, 2008, and May 3, 2008 was $2,823, $2,999, $4,077, $3,068, $3,121, and $3,429,

respectively. Operating Income (Loss) was unaffected by these reclassification adjustments.

Effective February 1, 2009, the Company retrospectively adopted ASC 470 related to accounting for convertible debt instruments that may be settled in

cash upon conversion (including partial cash settlement). In March 2004, the Company issued $230,000 of 2.00% convertible senior notes that mature in 2024

(the “2.0% Convertible Senior Notes”). The 2.0% Convertible Senior Notes are within the scope of ASC 470, which requires an allocation of convertible debt

proceeds between the liability component and the embedded conversion option (i.e., the equity component). The adoption of this pronouncement decreased

income (loss) from continuing operations and net income (loss) by $990, $974, $958, and $941 for the quarterly periods ended January 31, 2009, November 1,

2008, August 2, 2008, and May 3, 2008, respectively. Basic and diluted earnings (loss) per share decreased by $.01 for the quarterly periods ended November 1,

2008, August 2, 2008, and May 3, 2008, respectively. There was no impact on basic and diluted loss per share for the quarterly period ended January 31, 2009.

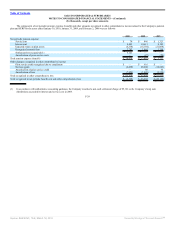

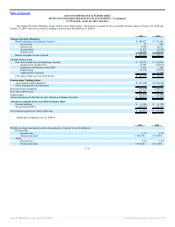

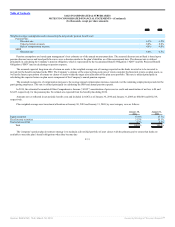

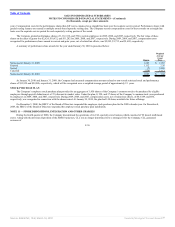

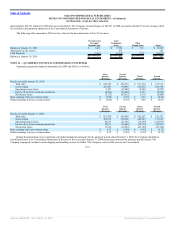

NOTE 13 — CONDENSED CONSOLIDATING FINANCIAL INFORMATION

The following tables present condensed consolidating financial information for 2009, 2008, and 2007 for: (1) Saks Incorporated and (2) on a combined

basis, the guarantors of Saks Incorporated’s senior notes (which are all of the wholly owned subsidiaries of Saks Incorporated).

The condensed consolidating financial statements presented as of and for the years ended January 30, 2010, January 31, 2009, and February 2, 2008 reflect

the legal entity compositions at the respective dates. Certain prior period amounts have been revised to reflect the adjustment to Net Sales and SG&A to reflect

all shipping and handling revenue in Net Sales (see Note 2).

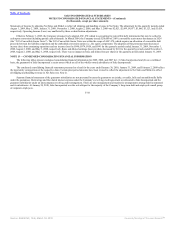

Separate financial statements of the guarantor subsidiaries are not presented because the guarantors are jointly, severally, fully and unconditionally liable

under the guarantees. Borrowings and the related interest expense under the Company’s revolving credit agreement are allocated to Saks Incorporated and the

guarantor subsidiaries under an intercompany revolving credit arrangement. There are also management and royalty fee arrangements among Saks Incorporated

and its subsidiaries. At January 30, 2010, Saks Incorporated was the sole obligor for the majority of the Company’s long-term debt and employed a small group

of corporate employees.

F-38

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠