Saks Fifth Avenue 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

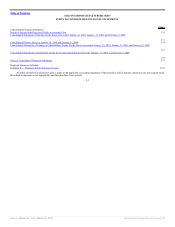

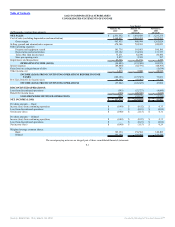

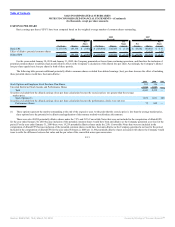

SAKS INCORPORATED & SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

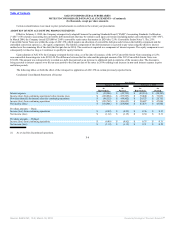

Year Ended

(In Thousands)

January 30,

2010

January 31,

2009

(Revised)

February 2,

2008

(Revised)

OPERATING ACTIVITIES

Net income (loss) $ (57,919) $ (158,804) $ 43,882

Loss from discontinued operations (257) (32,179) (3,214)

Income (loss) from continuing operations (57,662) (126,625) 47,096

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating

activities:

Loss (gain) on extinguishment of debt (783) — 5,634

Depreciation and amortization 135,162 134,694 131,737

Equity compensation 16,846 16,354 7,724

Amortization of discount on convertible notes 9,819 6,811 6,404

Deferred income taxes (40,585) (49,780) 23,788

Impairments and dispositions 29,348 11,139 4,279

Gain on lease termination — — (1,669)

Gain on sale of property (628) (3,400) (1,069)

Changes in operating assets and liabilities:

Merchandise inventories 79,645 118,539 (71,032)

Other current assets 11,409 20,990 12,495

Accounts payable and accrued liabilities 13,577 (114,577) (119,846)

Other operating assets and liabilities 9,727 3,025 21,858

Net Cash Provided By Operating Activities — Continuing Operations 205,875 17,170 67,399

Net Cash Provided By (Used In) Operating Activities — Discontinued Operations (13,670) (18,667) 4,080

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES 192,205 (1,497) 71,479

INVESTING ACTIVITIES

Purchases of property and equipment (74,577) (127,305) (136,726)

Proceeds from sale of property and equipment 643 4,338 12,352

Net Cash Used In Investing Activities — Continuing Operations (73,934) (122,967) (124,374)

Net Cash Used In Investing Activities — Discontinued Operations — (1,875) (4,259)

NET CASH USED IN INVESTING ACTIVITIES (73,934) (124,842) (128,633)

FINANCING ACTIVITIES

Proceeds from issuance of convertible senior notes 120,000 — —

Payments of deferred financing costs (13,105) — —

Proceeds from (payments on) revolving credit facility (156,675) 156,675 —

Payments on long-term debt and capital lease obligations (26,881) (89,242) (118,980)

Cash dividends paid (781) (1,183) (7,430)

Purchases of common stock — (34,889) (27,464)

Net proceeds from issuance of common stock 96,199 4,089 34,307

Net Cash Provided By (Used In) Financing Activities — Continuing Operations 18,757 35,450 (119,567)

Net Cash Used In Financing Activities — Discontinued Operations — — —

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES 18,757 35,450 (119,567)

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 137,028 (90,889) (176,721)

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 10,273 101,162 277,883

CASH AND CASH EQUIVALENTS AT END OF YEAR $ 147,301 $ 10,273 $ 101,162

Non-cash investing and financing activities are further described in the accompanying notes.

The accompanying notes are an integral part of these consolidated financial statements.

F-6

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠