Saks Fifth Avenue 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

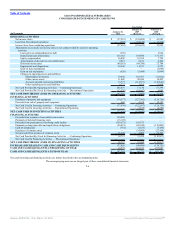

Table of Contents

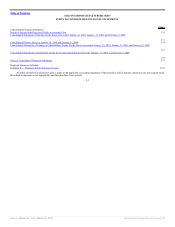

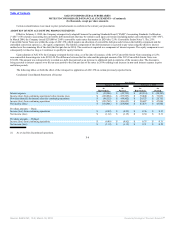

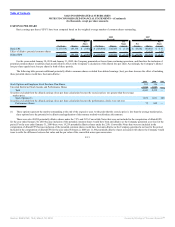

SAKS INCORPORATED & SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In Thousands)

Common

Stock

Shares

Common

Stock

Amount

Additional

Paid-In

Capital

Retained

Earnings

(Accumulated

Deficit)

Accumulated

Other

Comprehensive

Loss

Total

Shareholders’

Equity

Balance at February 3, 2007, as reported 140,440 $ 14,048 $ 1,097,817 $ 12,620 $ (28,346) $ 1,096,139

Adoption of ASC 470 (Note 2) — — 43,028 (10,608) — 32,420

Balance at February 3, 2007, revised 140,440 $ 14,048 $ 1,140,845 $ 2,012 $ (28,346) $ 1,128,559

Net income 43,882 43,882

Change in minimum pension liability, net of tax 13,344 13,344

Comprehensive income 57,226

Adoption of accounting for uncertain tax positions 36,528 (2,858) 33,670

Issuance of common stock 2,930 293 34,014 34,307

Income tax provision adjustment related to

employee stock plans (454) (454)

Increase in tax valuation allowance (19,258) (19,258)

Net activity under stock compensation plans 136 11 (9,887) (9,876)

Stock-based compensation 7,724 7,724

Repurchase of common stock (1,722) (172) (27,292) (27,464)

Balance at February 2, 2008 141,784 $ 14,180 $ 1,162,220 $ 43,036 $ (15,002) $ 1,204,434

Net loss (158,804) (158,804)

Change in minimum pension liability, net of tax (41,434) (41,434)

Comprehensive loss (200,238)

Pension measurement date change 345 345

Issuance of common stock 636 64 4,025 4,089

Income tax provision adjustment related to

employee stock plans 1,352 1,352

Net activity under stock compensation plans 2,699 269 (1,130) (861)

Stock-based compensation 16,354 16,354

Repurchase of common stock (2,949) (295) (34,594) (34,889)

Balance at January 31, 2009 142,170 $ 14,218 $ 1,148,227 $ (115,423) $ (56,436) $ 990,586

Net loss (57,919) (57,919)

Change in minimum pension liability, net of tax 7,636 7,636

Comprehensive loss (50,283)

Issuance of common stock, net 15,097 1,509 94,689 96,198

Income tax provision adjustment related to

employee stock plans (2,491) (2,491)

Issuance of 7.5% Convertible Notes 21,147 21,147

Net activity under stock compensation plans 2,519 252 (645) (393)

Stock-based compensation 16,846 16,846

Balance at January 30, 2010 159,786 $ 15,979 $ 1,277,773 $ (173,342) $ (48,800) $ 1,071,610

The accompanying notes are an integral part of these consolidated financial statements.

F-5

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠