Saks Fifth Avenue 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

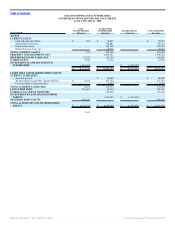

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

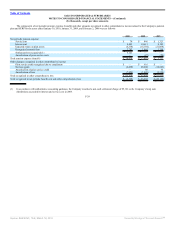

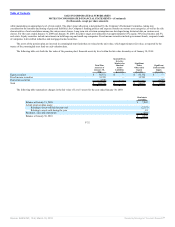

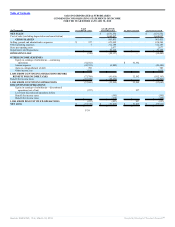

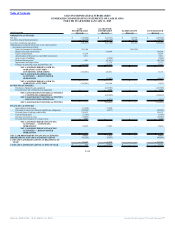

The following table summarizes information about stock options outstanding at January 30, 2010:

Options Outstanding Options Exercisable

Range of Exercise Prices

Number

Outstanding

at January 30,

2010

Weighted

Average

Remaining

Contractual

Life (Years)

Weighted

Average

Exercise

Price

Number

Exercisable

at January 30,

2010

Weighted

Average

Remaining

Contractual

Life (Years)

Weighted

Average

Exercise

Price

$2.36 to $6.64 906 4.7 $ 3.46 256 1.1 $ 6.25

$6.65 to 8.07 36 1.9 $ 7.82 36 1.9 $ 7.82

$8.08 to $13.04 838 5.1 $ 13.04 210 5.1 $ 13.04

$13.05 to $20.31 528 4.1 $ 19.80 264 4.1 $ 19.80

2,308 4.7 $ 10.75 766 3.3 $ 12.86

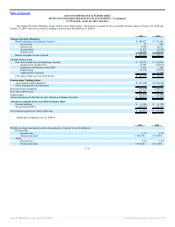

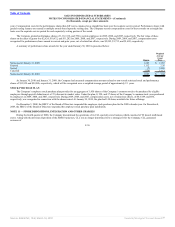

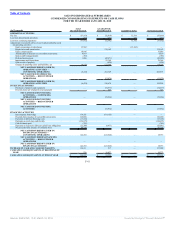

RESTRICTED STOCK AND PERFORMANCE SHARES

The Company granted restricted stock awards of 2,351, 2,184, and 406 shares to certain employees in 2009, 2008, and 2007, respectively. The fair value of

the restricted stock is based on the market value of the Company’s common stock on the date of grant. The fair value of these shares on the dates of grants was

$7,029, $27,934, and $8,843 for 2009, 2008, and 2007, respectively. During 2009, 2008, and 2007, compensation costs, net of related tax effects, of $6,694,

$6,511, and $2,162, respectively, was recognized in connection with the Company’s restricted stock grants.

Compensation costs for the restricted stock awards that cliff vest is expensed on a straight line basis over the requisite service period. Restricted stock with

graded vesting features are treated as multiple awards based upon the vesting date. The Company records compensation costs for these awards on a straight line

basis over the requisite service period for each separately vesting portion of the award.

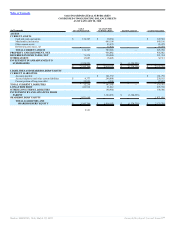

A summary of restricted stock awards for the year ended January 30, 2010 is presented below:

Shares

Weighted

Average

Grant

Price

Nonvested at January 31, 2009 2,719 $ 14.43

Granted 2,351 2.99

Vested (200) 19.01

Canceled (78) 10.77

Nonvested at January 30, 2010 4,792 $ 8.68

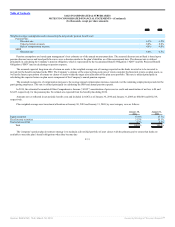

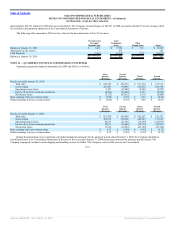

The Company granted performance shares under its long-term incentive plan. The fair value of the performance shares is based on the market value of the

Company’s common stock on the date of grant. The actual number of performance shares earned is based on the level of performance achieved relative to

established operating (non-market condition) goals for the one-year performance period beginning February 1, 2009 and range from 0% to 100% of the target

number of performance shares granted. In addition, once earned, performance shares are not payable unless the grantee remains employed by the Company for an

additional two

F-35

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠