Saks Fifth Avenue 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

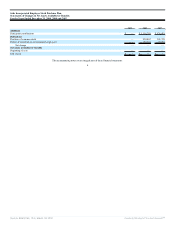

Saks Incorporated Employee Stock Purchase Plan

Notes to Financial Statements

For the Years Ended December 31, 2009, 2008, and 2007

1. Summary of Significant Accounting Policies and Description of the Plan

The following description of the Saks Incorporated Employee Stock Purchase Plan, as amended effective September 16, 2008, (the “Plan”) is provided for

general information only. Participants should refer to the Plan agreement for a more complete description of the Plan’s provisions.

General

The Plan provides employees of Saks Incorporated and Subsidiaries (the “Company”) an opportunity to purchase shares of common stock of the Company

at a 15% discount to market value. The Plan is intended to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code of

1986, as amended (the “IRC”), and is therefore not subject to federal and state income taxes.

The Board of Directors authorized, and shareholders approved an aggregate of 700,000 shares available for purchase under the Plan. The number of shares

of common stock to be issued under the Plan and the period for which the option to purchase shares will remain outstanding (the “Option Period”) are

based on the determination of the Human Resources and Compensation Committee (the “HRCC”) of the Company’s Board of Directors. Option periods

currently end on December 31 of each year. The price at which the stock may be purchased is 85% of the lesser of the closing price per share as listed on

the New York Stock Exchange on the last business day preceding (i) the grant of the option, or (ii) the exercise of the option.

The Plan was suspended for the year ended December 31, 2009 (see Note 2) and therefore, there were no shares purchased for the year ended

December 31, 2009. The Plan purchased 250,012 shares at an option price of $3.72 and 37,342 shares at an option price of $15.15 for the years ended

December 31, 2008 and 2007, respectively. Currently, the Plan has 148,272 shares available for future offerings.

Eligibility

Any employee of the Company who works at least 20 hours a week for the Company and has been employed by the Company for at least one year is

eligible to participate in the Plan.

Contributions

Eligible employees may elect annually to make after-tax contributions to the Plan through payroll deductions and are automatically re-enrolled in the Plan

each year unless they withdraw, cease employment with the Company or choose to elect a different rate of payroll deduction. Participant contributions are

limited for each offering at the discretion of the HRCC. Each participant’s account is credited with the participant’s contributions. Participants are fully

vested in their contributions. The contribution limitation was $2,400 for the years ended December 31, 2008 and 2007. No contributions were made during

the 2009 plan year.

Distribution of Stock

As soon as practicable after the purchase of stock by the Plan for its participants, the Company will deposit said shares into their account.

Administrative Expenses

The Company pays for all administrative expenses of the Plan.

Income Taxes

Participants are not taxed upon receipt or exercise of options, but rather upon disposition of shares purchased under the Plan.

Basis of Accounting

The financial statements have been prepared on the accrual basis of accounting.

5

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠