Saks Fifth Avenue 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Description

Starting

Basis

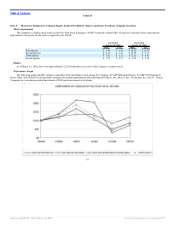

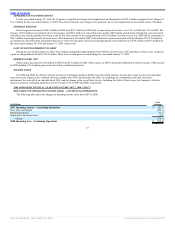

1/29/05 1/28/06 2/3/07 2/2/08 1/31/09 1/30/10

Saks Incorporated $ 100.00 $ 137.75 $ 217.71 $ 205.39 $ 28.22 $ 72.12

S&P Midcap 400 $ 100.00 $ 123.18 $ 135.57 $ 134.06 $ 82.57 $ 118.37

S&P 500 Department Stores $ 100.00 $ 116.76 $ 167.93 $ 107.22 $ 50.65 $ 84.67

Retail Peer Group $ 100.00 $ 139.52 $ 189.41 $ 123.72 $ 41.20 $ 83.52

This “Performance Graph” section shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C or to

the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Dividends

During the fiscal years ended January 30, 2010 and January 31, 2009, the Company did not declare any dividends. Future dividends, if any, will be

determined by the Company’s Board of Directors in light of circumstances then existing, including earnings, financial requirements, and general business

conditions. The Company does not anticipate declaring dividends in the foreseeable future.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The Company has a share repurchase program that authorizes it to purchase shares of the Company’s common stock. The Company did not repurchase any

shares of common stock during 2009. The Company has remaining availability of approximately 32.7 million shares under its 70 million authorized share

repurchase program.

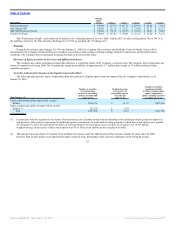

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides equity compensation plan information for all plans approved and not approved by the Company’s shareholders, as of

January 30, 2010:

Plan Category (1)

Number of securities

to be issued upon

exercise of outstanding

options, warrants and

rights (#) (a)

Weighted-average

exercise price of

outstanding options,

warrants and

rights ($) (b)

Number of securities

remaining available

for future issuance under

equity compensation

plans (excluding securities

in column (a)) (2) (c)

Equity compensation plans approved by security

holders 2,016,731 $ 11.37 6,027,589

Equity compensation plans not approved by security

holders (3) 257,235 $ 6.43 —

Total 2,273,966 $ 10.81 6,027,589

(1) In connection with the acquisition of its former Parisian business, the Company assumed then-outstanding stock options previously granted to employees

and directors of the acquired corporation. No additional grants or awards may be made under the plan pursuant to which these stock options were granted.

As of January 30, 2010, the total number of shares of Common Stock to be issued upon exercise of these stock options was 34,707 and the

weighted-average exercise price of these stock options was $6.54. These stock options are not included in the table.

(2) This amount represents shares of Common Stock available for issuance under the 2009 Incentive Plan. Awards available for grant under the 2009

Incentive Plan include options, stock appreciation rights, restricted stock, performance units, and any combination of the foregoing awards.

19

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠