Saks Fifth Avenue 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

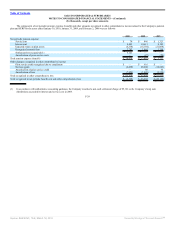

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

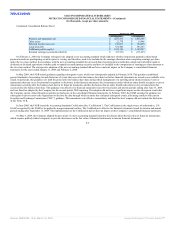

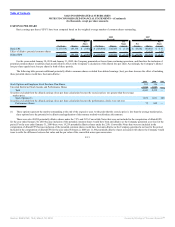

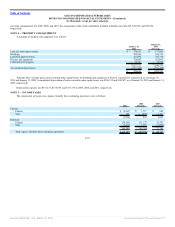

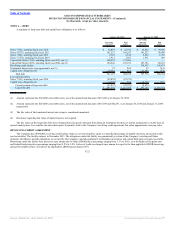

Income tax (benefit) expense from continuing operations varies from the amounts computed by applying the statutory federal income tax rate to income

before taxes. The reasons for these differences were as follows:

2009

2008

(Revised)

2007

(Revised)

Expected federal income taxes at 35% $ (35,757) $ (61,434) $ 25,848

State income taxes, net of federal benefit (4,267) (6,777) 3,095

State NOL valuation allowance adjustment 3,045 6,110 (2,957)

Effect of settling tax exams and other tax reserve adjustments (5,226) 624 690

Executive compensation — 318 367

Tax-exempt interest — — (662)

Change in state tax law — (414) —

State tax rate adjustment (2,703) — —

Write-off of expired Federal NOL — 10,980 —

Other items, net 407 1,691 374

Provision (benefit) for income taxes from continuing operations $ (44,501) $ (48,902) $ 26,755

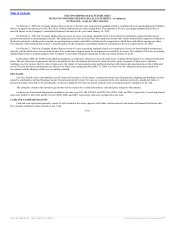

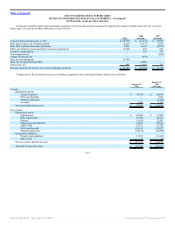

Components of the net deferred tax asset or liability recognized in the consolidated balance sheets were as follows:

January 30,

2010

January 31,

2009

(Revised)

Current:

Deferred tax assets:

Accrued expenses $ 34,478 $ 28,099

NOL carryforwards — 1,029

Valuation allowance — (2,322)

Inventory 1,496 3,110

Net current deferred tax asset $ 35,974 $ 29,916

Non-current:

Deferred tax assets:

Capital leases $ 22,000 $ 23,968

Rent Adjustments 20,384 18,433

Pension 14,638 15,993

Other long-term liabilities 33,853 29,036

AMT Credit 23,103 24,269

NOL carryforwards 138,122 134,557

Valuation allowance (42,810) (39,868)

Deferred tax liabilities:

Property and equipment 12,053 (11,446)

Other assets 11 14

Net non-current deferred tax asset $ 221,354 $ 194,956

Total Net Deferred Tax Asset $ 257,328 $ 224,872

F-19

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠