Saks Fifth Avenue 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

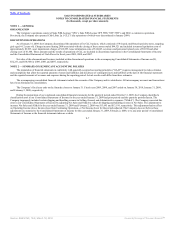

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement

cost). The standard utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The FASB’s

guidance classifies the inputs used to measure fair value into the following hierarchy:

Level 1: Quoted market prices in active markets for identical assets or liabilities

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data

Level 3: Unobservable inputs reflecting the reporting entity’s own assumptions

The Company may also be required, from time to time, to measure certain other financial assets and liabilities at fair value on a non-recurring basis in

accordance with GAAP.

As of January 30, 2010, the Company had no material financial assets or liabilities measured on a recurring basis that required adjustments or write-downs.

IMPAIRMENTS & DISPOSITIONS

The Company continuously evaluates its real estate portfolio and closes individual underproductive stores in the normal course of business as leases expire

or as other circumstances indicate. The Company reviews the carrying amounts of individual stores at each fiscal year end or whenever events or changes in

circumstances indicate that the carrying amount may not be recoverable. When evaluating individual stores for impairment, the Company’s asset group is at an

individual store level, which is the lowest level for which cash flows are identifiable.

A potential impairment has occurred if projected future undiscounted cash flows expected to result from the use and eventual disposition of the store assets

are less than the carrying value of the assets. These cash flows are calculated at the individual store level. When determining the cash flows associated with an

individual store, management must make assumptions about key store variables, including sales, gross margin and expenses such as store payroll and occupancy

costs.

An impairment loss is recognized when the carrying amount of the operating store is not recoverable and exceeds its fair value. The Company uses an

income-based approach to determine the fair value of its individual stores that involves making assumptions regarding both a store’s future cash flows, as

described above, and the discount rate to determine the present value of those future cash flows. The Company discounts its cash flows at a rate equal to the

average of its weighted average cost of capital and the weighted average cost of capital of its competitors as an estimate of the rate that market participants would

use in pricing the assets. The Company has not made any material changes in the methodology used to estimate the future cash flows of its stores during the past

three fiscal years.

Additionally, the Company disposes of certain assets during the year in the normal course of business.

The fair value of the assets impaired at January 30, 2010 was $20,725 and was classified as Level 3 within the fair value hierarchy. During the year ended

January 30, 2010, January 31, 2009, and February 2, 2008, the Company incurred impairment and disposition charges of $29,348, $11,139, and $4,279,

respectively.

F-13

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠