Saks Fifth Avenue 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

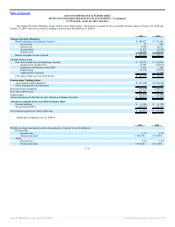

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

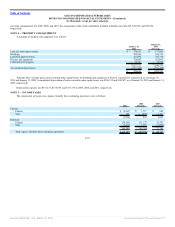

The federal and state net operating loss (“NOL”) carryforwards will expire between 2010 and 2029. The majority of the NOL carryforward is a result of

the net operating losses incurred during the fiscal years ended January 30, 2010 and January 31, 2009 due principally to difficult market and macroeconomic

conditions. We have concluded, based on the weight of all available positive and negative evidence that all but $42,810 of these tax benefits relating to certain

state losses are more likely than not to be realized in the future. Therefore, a valuation allowance for the $42,810 has been established.

We evaluate the realizability of our deferred tax assets on a quarterly basis. This evaluation resulted in an additional reserve of $3,045 and $6,110 against

state deferred tax assets in 2009 and 2008, respectively, impacting our results of operations. A similar analysis was performed in 2007, which resulted in a

decrease in the reserve of $2,957. While the Company has incurred a cumulative loss over the three year period ended January 30, 2010, after evaluating all

available evidence including our past operating results, the macroeconomic factors contributing to the most recent fiscal loss, the length of the carryforward

periods available and our forecast of future taxable income, including the availability of prudent and feasible tax planning strategies, we concluded that it is more

likely than not the deferred tax asset, net of the $42,810 valuation allowance related to state NOLs, will be realized. We will continue to assess the need for

additional valuation allowance in the future. If future results are less than projected or tax planning strategies are no longer viable, then additional valuation

allowance may be required to reduce the deferred tax assets which could have a material impact on our results of operations in the period in which it is recorded.

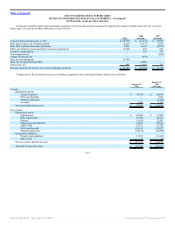

Included in the NOL carryforward deferred tax asset at January 30, 2010 is $82,174 related to U.S. federal NOL carryforwards of $234,784. The total

federal NOL carryforwards are $261,296 which includes $26,512 of excess tax deductions associated with our stock option plans which have yet to reduce taxes

payable. Upon the utilization of these carryforwards, the associated tax benefits of $9,279 will be recorded to Additional Paid-in-Capital.

The Company received income tax refunds of $4,727, $10,214, and, $17,492 during 2009, 2008, and 2007, respectively.

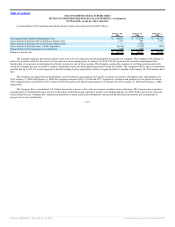

The company adopted the provisions of new accounting guidance related to uncertain income tax positions as of February 4, 2007. As a result of the

implementation of this accounting guidance, the Company recorded a $33,671 decrease in the liability for unrecognized tax benefits which was accounted for as

an increase to the beginning shareholder’s equity. As a result of the analysis of uncertain tax positions, the net deferred tax asset related to state NOL

carryforwards increased by $19,258. Therefore, the Company performed a valuation allowance analysis to determine the realizability of this asset. This analysis

resulted in an additional valuation allowance of $19,258 with the offset recorded to shareholders’ equity in accordance with the relevant accounting guidance for

entities in reorganization under the bankruptcy code. The Company was subject to the provisions of this accounting guidance for these net operating losses since

these losses were acquired through the acquisition of a company that had previously filed bankruptcy.

F-20

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠