Saks Fifth Avenue 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

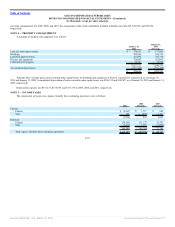

equivalents are stated at cost, which approximates fair value. Cash equivalents totaled $136,347 and $236 at January 30, 2010 and January 31, 2009, respectively,

primarily consisting of money market funds, demand deposits, and time deposits. Income earned on cash equivalents was $358, $1,958, and $6,190 for the fiscal

years ended January 30, 2010, January 31, 2009, and February 2, 2008, respectively, and was reflected in Other Income in the accompanying Consolidated

Statements of Income. At January 30, 2010, the Company had a $20,000 compensating balance related to the Company’s purchasing card program to ensure

future credit availability under that program.

MERCHANDISE INVENTORIES AND COST OF SALES

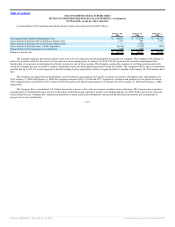

Merchandise inventories are stated at the lower of cost or market and include freight, buying and distribution costs. The Company takes markdowns

related to slow moving inventory, ensuring the appropriate inventory valuation. On February 3, 2008, the Company elected to change its method of costing its

inventories to the retail “first-in, first-out” (FIFO) method, whereas in all prior periods inventory was costed using the retail “last-in, first-out” (LIFO) method.

The new method of accounting had no impact on the fiscal years ending January 30, 2010 and January 31, 2009 as the LIFO value exceeded the FIFO market

value and inventory had been adjusted to reflect FIFO market value in all periods.

The Company regularly records a provision for estimated shrinkage, thereby reducing the carrying value of merchandise inventory. A complete physical

inventory of all the Company’s stores and distribution facilities is performed annually, with the recorded amount of merchandise inventory being adjusted to

coincide with this physical count. The differences between the estimated amount of shrinkage and the actual amount realized have been insignificant.

The Company receives vendor provided support in different forms. When the vendor provides support for inventory markdowns, the Company records the

support as a reduction to cost of sales. Such support is recorded in the period that the corresponding markdowns are taken. When the Company receives

inventory-related support that is not designated for markdowns, the Company includes this support as a reduction in the cost of purchases.

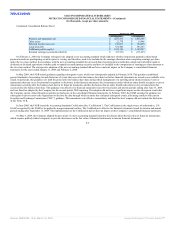

Consignment merchandise on hand of $142,928 and $138,762 at January 30, 2010 and January 31, 2009, respectively, is not reflected in the consolidated

balance sheets.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

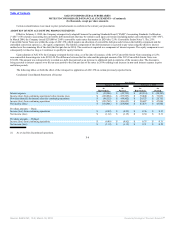

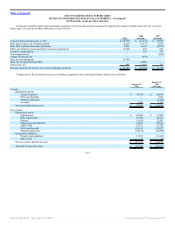

SG&A expenses are comprised principally of the costs related to employee compensation and benefits in the selling and administrative support areas,

exclusive of payroll taxes; advertising; store and headquarters occupancy, operating and maintenance costs exclusive of rent, depreciation, and property taxes;

proprietary credit card promotion, issuance and servicing costs; insurance programs; telecommunications; and other operating expenses not specifically

categorized elsewhere in the Consolidated Statements of Income. Advertising and sales promotion costs are generally expensed in the period in which the

advertising event takes place. The Company receives allowances and expense reimbursements from merchandise vendors and from the owner of the proprietary

credit card portfolio which are netted against the related expense:

• Allowances received from merchandise vendors in conjunction with incentive compensation programs for employees who sell the vendors’

merchandise and netted against the related compensation expense were $41,846, $54,653, and $57,348 in 2009, 2008, and 2007, respectively.

F-11

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠