Saks Fifth Avenue 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts)

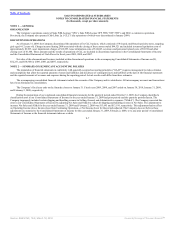

NOTE 1 — GENERAL

ORGANIZATION

The Company’s operations consist of Saks Fifth Avenue (“SFA”), Saks Fifth Avenue OFF 5TH (“OFF 5TH”), and SFA’s e-commerce operations.

Previously, the Company also operated Club Libby Lu (“CLL”) (the operations of which were discontinued in January 2009).

DISCONTINUED OPERATIONS

As of January 31, 2009, the Company discontinued the operations of its CLL business, which consisted of 98 leased, mall-based specialty stores, targeting

girls aged 4-12 years old. Charges incurred during 2008 associated with the closing of these stores totaled $44,521 and included inventory liquidation costs of

approximately $6,965, asset impairments charges of $16,993, lease termination costs of $14,045, severance and personnel related costs of $5,074 and other

closing costs of $1,444. These amounts and the results of operations of CLL are included in discontinued operations in the Consolidated Statements of Income

and the Consolidated Statements of Cash Flows for fiscal years 2009, 2008, and 2007.

Net sales of the aforementioned business included within discontinued operations in the accompanying Consolidated Statements of Income are $0,

$52,231, and $58,564 for 2009, 2008, and 2007, respectively.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements

and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany accounts and transactions

have been eliminated in consolidation.

The Company’s fiscal year ends on the Saturday closest to January 31. Fiscal years 2009, 2008, and 2007 ended on January 30, 2010, January 31, 2009,

and February 2, 2008, respectively.

During the preparation of our condensed consolidated financial statements for the quarterly period ended October 31, 2009, the Company identified a

classification error in our Consolidated Statements of Income for the year ended January 31, 2009 and prior periods and the quarterly periods therein. The

Company improperly included certain shipping and handling revenue in Selling, General and Administrative expenses (“SG&A”). The Company corrected this

error in our Consolidated Statements of Income by adjusting Net Sales and SG&A to reflect all shipping and handling revenue in Net Sales. The adjustment to

increase Net Sales and SG&A for the year ended January 31, 2009 and February 2, 2008 was $13,695 and $13,199, respectively. This adjustment had no effect

on Operating Income (loss), Income (loss) from Continuing Operations, or Net Income (loss) for the periods adjusted. The Company does not believe these

adjustments are material to the Consolidated Statements of Income for the year ended January 31, 2009, February 2, 2008, or to any prior period’s Consolidated

Statements of Income or the financial statements taken as a whole.

F-7

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠