Saks Fifth Avenue 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

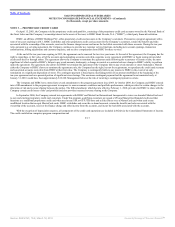

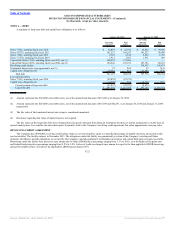

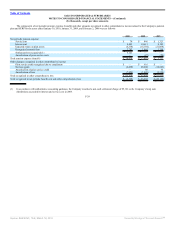

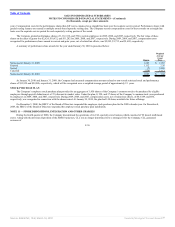

Total rental expense for operating leases was $101,756, $101,063, and $100,106 during 2009, 2008, and 2007, respectively, including contingent rent of

$13,301, $17,381, and $19,612, respectively, and common area maintenance costs of 12,299, $12,702, and $10,297, respectively.

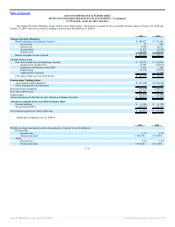

As of January 30, 2010, the Company had two potential commitments tied to the value of its common stock. First, the Company may be required to deliver

shares and/or cash to holders of the convertible notes described in Note 6 prior to the stated maturity date of said notes based on the value of the Company’s

common stock. Second, in connection with the issuance of the convertible notes, the Company bought and sold call options to limit the potential dilution from

conversion of the notes. The Company may be required to deliver shares and/or cash to the holders of the call options based on the value of the Company’s

common stock.

In the normal course of business, the Company purchases merchandise under purchase commitments; enters into contractual commitments with real estate

developers and construction companies for new store construction and store remodeling; and maintains contracts for various information technology,

telecommunications, maintenance and other services. Commitments for purchasing merchandise generally do not extend beyond six months and may be

cancelable several weeks prior to the vendor shipping the merchandise. Contractual commitments for the construction and remodeling of stores are typically

lump sum or cost plus construction contracts. Contracts to purchase various services are generally less than one to two year commitments and are cancelable

within several weeks notice.

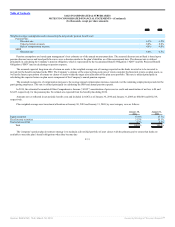

From time to time the Company has issued guarantees to landlords under leases of stores operated by its subsidiaries. Certain of these stores were sold in

connection with the Saks Department Store Group (“SDSG”), and the Northern Department Store Group transactions which occurred in July 2005 and March

2006 respectively. If the purchasers fail to perform certain obligations under the leases guaranteed by the Company, the Company could have obligations to

landlords under such guarantees. Based on the information currently available, management does not believe that its potential obligations under these lease

guarantees would be material.

LEGAL CONTINGENCIES

The Company is involved in legal proceedings arising from its normal business activities and has accruals for losses where appropriate. Management

believes that none of these legal proceedings will have a material adverse effect on the Company’s consolidated financial position, results of operations, or

liquidity.

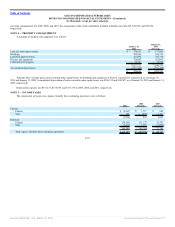

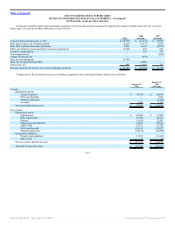

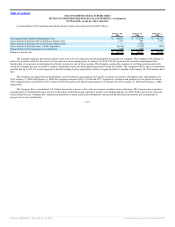

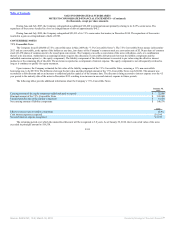

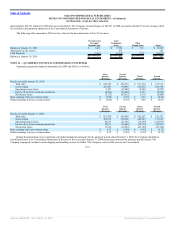

INCOME TAXES

The Company is routinely under audit by federal, state or local authorities in the areas of income taxes and the remittance of sales and use taxes. These

audits include questioning the timing and amount of deductions and the allocation of income among various tax jurisdictions. Based on annual evaluations of tax

filing positions, the Company believes it has adequately accrued for its income tax exposures. To the extent the Company were to prevail in matters for which

accruals have been established or be required to pay amounts in excess of the current reserves, the Company’s effective tax rate in a given financial statement

period may be materially impacted. At January 30, 2010 certain state examinations were ongoing.

F-27

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠