Saks Fifth Avenue 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

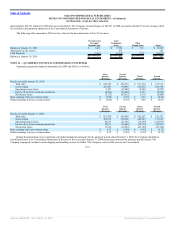

Table of Contents

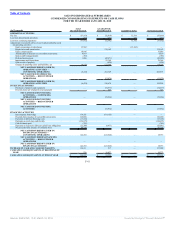

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

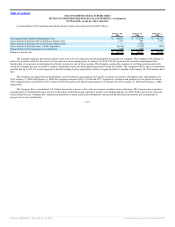

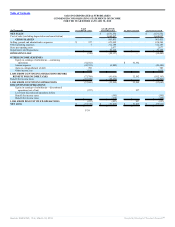

2009 2008

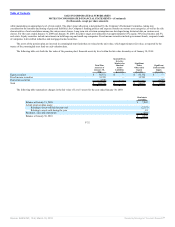

Weighted-average assumptions used in measuring the net periodic pension benefit cost:

Pension Plan:

Discount rate 6.5% 6.5%

Expected return on assets 8.0% 8.0%

Rate of compensation increase 4.0% 4.0%

SERP

Discount rate 6.6% 6.5%

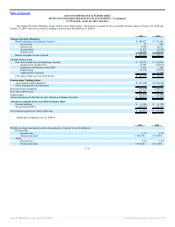

Pension assumptions are based upon management’s best estimates as of the annual measurement date. The assumed discount rate utilized is based upon

pension discount curves and bond portfolio curves over a duration similar to the plan’s liabilities as of the measurement date. The discount rate is utilized

principally in calculating the Company’s pension obligation, which is represented by the Accumulated Benefit Obligation (“ABO”) and the Projected Benefit

Obligation (“PBO”) and in calculating net pension expense.

The assumed expected long-term rate of return on assets is the weighted average rate of earnings expected on the funds invested or to be invested to

provide for the benefits included in the PBO. The Company’s estimate of the expected long-term rate of return considers the historical returns on plan assets, as

well as the future expectations of returns on classes of assets within the target asset allocation of the plan asset portfolio. This rate is utilized principally in

calculating the expected return on plan assets component of the Company’s annual pension expense.

The assumed average rate of compensation increase is the average annual compensation increase expected over the remaining employment periods for the

participating employees. This rate is utilized principally in calculating the PBO and annual pension expense.

In 2010, the estimated Accumulated Other Comprehensive Income (“AOCI”) amortization of prior service credit and amortization of net loss is $0 and

$2,427, respectively, for the pension plan. No refunds are expected from the benefit plan during 2010.

Amounts not yet reflected in net periodic benefit costs and included in AOCI as of January 30, 2010 and January 31, 2009 are $80,001 and $92,519,

respectively.

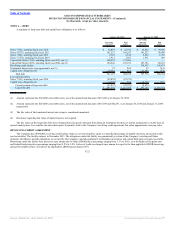

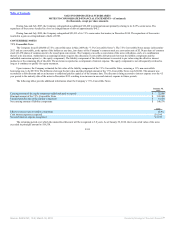

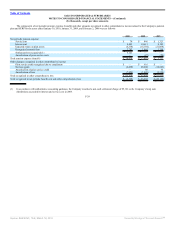

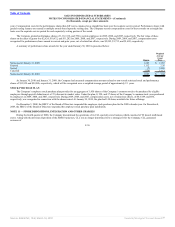

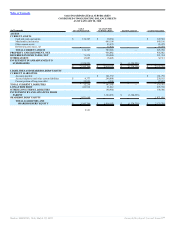

Plan weighted-average asset investment allocations at January 30, 2010 and January 31, 2009, by asset category were as follows:

January 30, January 31,

2010 2009

Equity securities 63.8% 55.7%

Fixed income securities 31.5% 36.1%

Real estate securities 4.7% 8.2%

Total 100.0% 100.0%

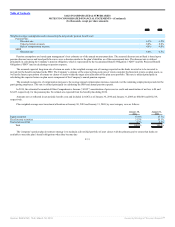

The Company’s pension plan investment strategy is to maintain a diversified portfolio of asset classes with the primary goal to ensure that funds are

available to meet the plan’s benefit obligations when they become due

F-31

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠