Saks Fifth Avenue 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

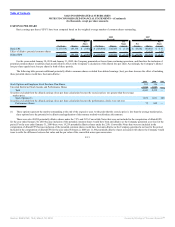

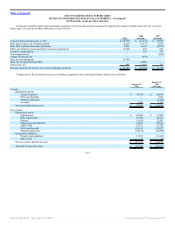

• Allowances received from merchandise vendors in conjunction with jointly produced and distributed print and television media and netted against the

gross expenditures for such advertising were $33,287, $45,813, and $48,896 in 2009, 2008, and 2007, respectively. Net advertising expenses were

$36,025, $39,358, and $42,058 in 2009, 2008, and 2007, respectively.

• Expense reimbursements received from the owner of the Company’s proprietary credit card portfolio are discussed at Note 3 to these financial

statements.

STORE PRE-OPENING COSTS

Store pre-opening costs primarily consist of rent expense incurred during the construction of new stores and payroll and related media costs incurred in

connection with new store openings and are expensed when incurred. Rent expense is generally incurred for six to twelve months prior to a store’s opening date.

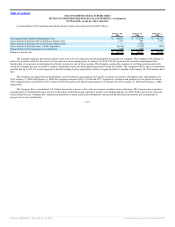

PROPERTY AND EQUIPMENT

Property and equipment are stated at historical cost less accumulated depreciation. For financial reporting purposes, depreciation is computed principally

using the straight-line method over the estimated useful lives of the assets. Buildings and improvements are depreciated over 20 to 40 years while fixtures and

equipment are primarily depreciated over 3 to 15 years. Leasehold improvements are amortized over the shorter of their estimated useful lives or their related

lease terms, generally ranging from 10 to 20 years. Terms of leases used in the determination of estimated useful lives may include renewal periods at the

Company’s option if exercise of the option is determined to be reasonably assured at the inception of the lease. Costs incurred for the development of internal

computer software are capitalized and amortized using the straight-line method over 3 to 10 years. Costs incurred in the discovery and post-implementation

stages of internally created computer software are generally expensed as incurred.

When constructing stores, the Company receives allowances from landlords. If the landlord is determined to be the primary beneficiary of the property,

then the portion of those allowances attributable to the property owned by the landlord is considered to be a deferred rent liability, whereas the corresponding

capital expenditures related to that store are considered to be prepaid rent. Allowances in excess of the amounts attributable to the property owned by the landlord

are considered leasehold improvement allowances and are recorded as deferred rent liabilities that are amortized over the life of the lease. Capital expenditures

are reduced when the Company receives cash and allowances from merchandise vendors to fund the construction of vendor shops.

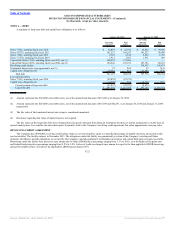

On a yearly basis and as changes in circumstances arise, the Company evaluates the recoverability of its property and equipment based upon the utilization

of the assets and expected future cash flows, in accordance with the authoritative accounting literature. Write-downs associated with the evaluation are reflected

in Impairments and Dispositions in the accompanying Consolidated Statements of Income.

FAIR VALUE MEASUREMENTS

The FASB’s accounting guidance defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date (exit price). The FASB guidance discusses valuation techniques, such as the market approach

(comparable market

F-12

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠