Saks Fifth Avenue 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

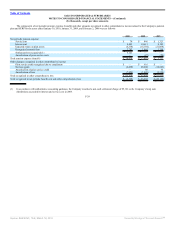

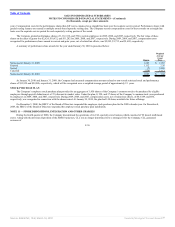

while maintaining an appropriate level of risk control. The plan’s target allocation is determined by the Company’s Retirement Committee, taking into

consideration the amounts and timing of projected liabilities, the Company’s funding policies and expected returns on various asset categories, as well as the risk

characteristics of and correlations among the various asset classes. Long term rate of return assumptions are developed using historical data on various asset

classes. For the years ended January 31, 2009 and January 30, 2010, the plan’s target asset allocation was approximately 65% equity, 30% fixed income and 5%

real estate. Equity securities include investments in both large-cap and small-cap companies. Fixed income securities include government bonds, corporate bonds

of companies in diversified industries and mortgage-backed securities.

The assets of the pension plan are invested in commingled trust funds that are valued at the unit value, which approximates fair value, as reported by the

trustee of the commingled trust fund on each valuation date.

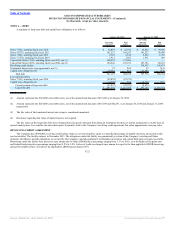

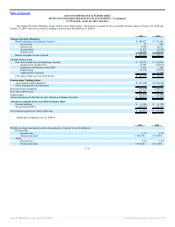

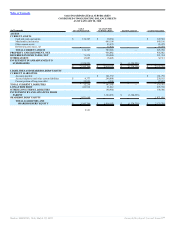

The following table sets forth the fair value of the pension plan’s financial assets by level within the fair value hierarchy as of January 30, 2010:

Total Plan

Assets as of

January 30,

2010

Quoted Prices

In Active

Markets for

Identical

Assets/

Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Equity securities $ 66,172 $ — $ 66,172 $ —

Fixed income securities 32,705 — 32,705 —

Real estate securities 4,878 — — 4,878

Total $ 103,755 $ — $ 98,877 $ 4,878

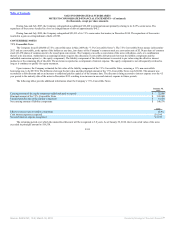

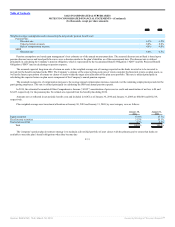

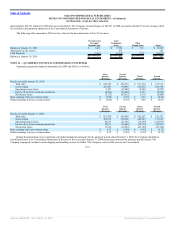

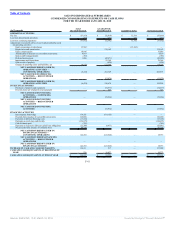

The following table summarizes changes in the fair value of Level 3 assets for the year ended January 30, 2010:

Real estate

securities

Balance at January 31, 2009 $ 7,843

Actual return on plan assets:

Relating to assets still held at year-end (2,757)

Relating to assets sold during the year 81

Purchases, sales and settlements (289)

Balance at January 30, 2010 $ 4,878

F-32

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠