Saks Fifth Avenue 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

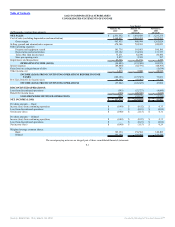

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

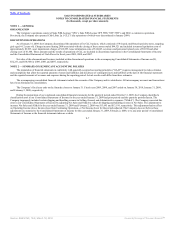

On February 1, 2009, the Company adopted the provisions of the fair value measurement standard related to nonfinancial assets and nonfinancial liabilities

that are recognized or disclosed at fair value in the financial statements on a nonrecurring basis. The adoption of the new accounting standard did not have a

material impact on the Company’s consolidated financial statement for the year ended January 30, 2010.

On February 1, 2009, the Company adopted the provisions of a new accounting standard related to accounting for instruments granted in share-based

payment transactions as participating securities. This update provides that unvested share-based payment awards that contain nonforfeitable rights to dividends or

dividend equivalents, whether paid or unpaid, are participating securities and shall be included in the computation of both basic and diluted earnings per share.

The adoption of this standard did not have a material impact on the Company’s consolidated financial statements for the year ended January 30, 2010.

On February 1, 2009, the Company adopted the provisions of a new accounting standard related to accounting by lessees for nonrefundable maintenance

deposits, which clarifies how a lessee shall account for a maintenance deposit under an arrangement accounted for as a lease. The adoption of the new accounting

standard did not have a material impact on the Company’s consolidated financial statements for the year ended January 30, 2010.

In December 2008, the FASB issued additional guidance on employers’ disclosures about the plan assets of defined benefit pension or other postretirement

plans. The new disclosure requirements include a description of how investment allocation decisions are made, major categories of plan assets, valuation

techniques used to measure the fair value of plan assets, the impact of measurement using significant unobservable inputs and concentrations of risk within plan

assets. The new disclosure requirements are effective for fiscal years ending after December 15, 2009. See Note 8 for the additional disclosures required in

accordance with the adoption of this new accounting standard.

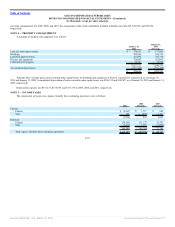

NET SALES

Net sales include sales of merchandise (net of returns and exclusive of sales taxes), commissions from leased departments, shipping and handling revenues

related to merchandise sold and breakage income from unredeemed gift cards. Net sales are recognized at the time customers provide a satisfactory form of

payment and take ownership of the merchandise or direct its shipment. Revenue associated with gift cards is recognized upon redemption of the card.

The Company estimates the amount of goods that will be returned for a refund and reduces sales and gross margin by that amount.

Commissions from leased departments included in net sales were $27,180, $28,083, and $30,189 in 2009, 2008, and 2007, respectively. Leased department

sales were $200,535, $210,284, and $217,636 in 2009, 2008, and 2007, respectively, and were excluded from net sales.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents primarily consist of cash on hand in the stores, deposits with banks, and investments with banks and financial institutions that

have original maturities of three months or less. Cash

F-10

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠