Saks Fifth Avenue 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

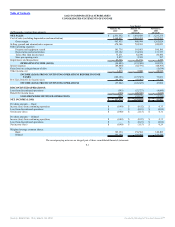

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

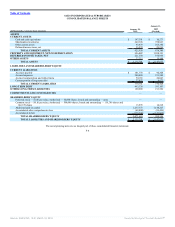

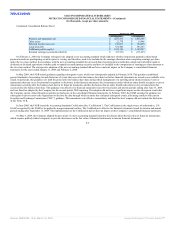

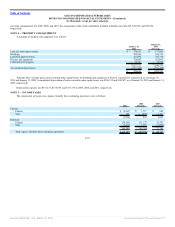

Condensed Consolidated Balance Sheet:

January 31, 2009

As Reported As Revised

Property and equipment, net $ 1,057,417 $ 1,058,393

Other assets $ 21,378 $ 19,948

Deferred income taxes, net $ 211,833 $ 194,956

Long-term debt $ 635,400 $ 593,103

Additional paid-in capital $ 1,105,199 $ 1,148,227

Retained earnings (accumulated deficit) $ (97,361) $ (115,423)

On February 1, 2009, the Company retrospectively adopted a new accounting standard which addresses whether instruments granted in share-based

payment awards are participating securities prior to vesting, and therefore, need to be included in the earnings allocation when computing earnings per share

under the two-class method. In accordance with the new accounting standard, the unvested share-based payment awards that contain non-forfeitable rights to

dividends or dividend equivalents (whether paid or unpaid) are participating securities and have be included in the computation of earnings per share pursuant to

the two-class method. The retrospective adoption of the new accounting standard did not have a material impact on the Company’s consolidated financial

statements for the years ended January 31, 2009 and February 2, 2008.

In May 2009, the FASB issued guidance regarding subsequent events, which was subsequently updated in February 2010. This guidance established

general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be

issued. In particular, this guidance sets forth the period after the balance sheet date during which management of a reporting entity should evaluate events or

transactions that may occur for potential recognition or disclosure in the financial statements, the circumstances under which an entity should recognize events or

transactions occurring after the balance sheet date in its financial statements, and the disclosures that an entity should make about events or transactions that

occurred after the balance sheet date. This guidance was effective for financial statements issued for fiscal years and interim periods ending after June 15, 2009,

and was therefore adopted by the Company for the second quarter 2009 reporting. The adoption did not have a significant impact on the subsequent events that

the Company reports, either through recognition or disclosure, in the consolidated financial statements. In February 2010, the FASB amended its guidance on

subsequent events to remove the requirement to disclose the date through which an entity has evaluated subsequent events, alleviating conflicts with current

Securities and Exchange Commission (“SEC”) guidance. This amendment was effective immediately and therefore the Company did not include the disclosure

in this Form 10-K.

In June 2009, the FASB issued the Accounting Standards Codification (the “Codification”). The Codification is the single source of authoritative, U.S.

GAAP recognized by the FASB to be applied by nongovernmental entities. The Codification is effective for financial statements issued for interim and annual

periods ending after September 15, 2009. The implementation of the Codification did not have an impact on the Company’s consolidated financial statements.

On May 3, 2009, the Company adopted the provisions of a new accounting standard related to disclosures about the fair value of financial instruments,

which requires publicly-traded companies to provide disclosures on the fair value of financial instruments in interim financial statements.

F-9

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠