Saks Fifth Avenue 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

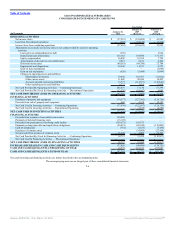

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

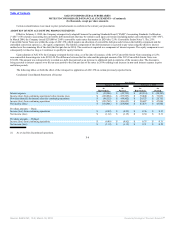

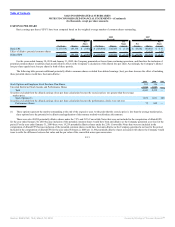

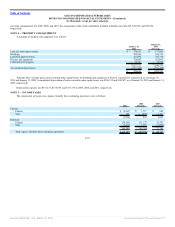

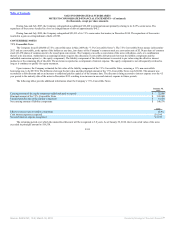

EARNINGS PER SHARE

Basic earnings per share (“EPS”) have been computed based on the weighted average number of common shares outstanding.

2009

2008

(Revised)

2007

(Revised)

Net Loss Shares

Per

Share

Amount Net Loss Shares

Per

Share

Amount

Net

Income Shares

Per

Share

Amount

Basic EPS $ (57,919) 143,194 $ (0.40) $ (158,804) 138,384 $ (1.15) $ 43,882 140,402 $ 0.31

Effect of dilutive potential common shares — — — — — — — 13,128 (.02)

Diluted EPS $ (57,919) 143,194 $ (0.40) $ (158,804) 138,384 $ (1.15) $ 43,882 153,530 $ 0.29

For the years ended January 30, 2010 and January 31, 2009, the Company generated net losses from continuing operations, and therefore the inclusion of

potential common shares would have had an anti-dilutive effect on the Company’s calculation of the diluted loss per share. Accordingly, the Company’s diluted

loss per share equals basic loss per share for both of these periods.

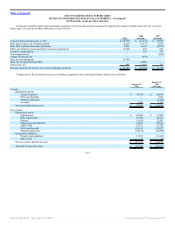

The following table presents additional potentially dilutive common shares excluded from diluted earnings (loss) per share because the effect of including

these potential shares would have been anti-dilutive:

2009 2008 2007

Stock Options and Employee Stock Purchase Plan Shares 101 346 —

Unvested Restricted Stock Awards and Performance Shares 3,944 1,889 —

Total 4,045 2,235 —

Securities excluded from the diluted earnings (loss) per share calculation because the exercise prices was greater than the average

market price

Stock Options (1) 1,659 1,811 688

Securities excluded from the diluted earnings (loss) per share calculation because the performance criteria were not met:

Performance Shares 75 845 —

(1) These options represent the number outstanding at the end of the respective year. At the point that the exercise price is less than the average market price,

these options have the potential to be dilutive and application of the treasury method would reduce this amount.

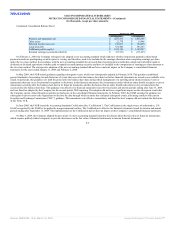

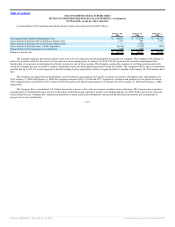

There were also 40,889 potentially dilutive shares under the 7.5% and 2.0% Convertible Notes that were not included in the computation of diluted EPS

for the year ended January 30, 2010 because inclusion of the potential common shares would have been anti-dilutive as the Company generated a net loss for the

period. For the year ended January 31, 2009 there were 19,219 potentially dilutive shares under the 2.0% Convertible Notes that were not included in the

computation of diluted EPS because inclusion of the potential common shares would have been anti-dilutive as the Company generated a net loss for the period.

Included in the computation of diluted EPS for the year ended February 2, 2008 are 11,190 potentially dilutive shares associated with shares the Company would

issue to settle the difference between fair value and the par value of the convertible notes upon conversion

F-15

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠