Saks Fifth Avenue 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

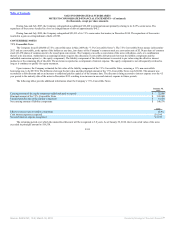

servicing compensation. For 2009, 2008, and 2007, the components of the credit contribution included in SG&A were $29,425, $29,899, and $28,754,

respectively.

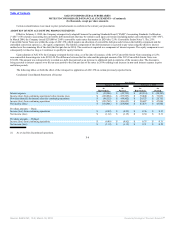

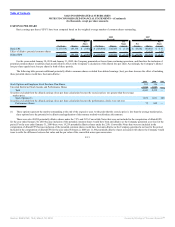

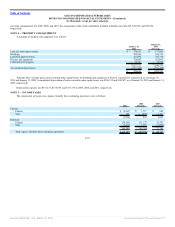

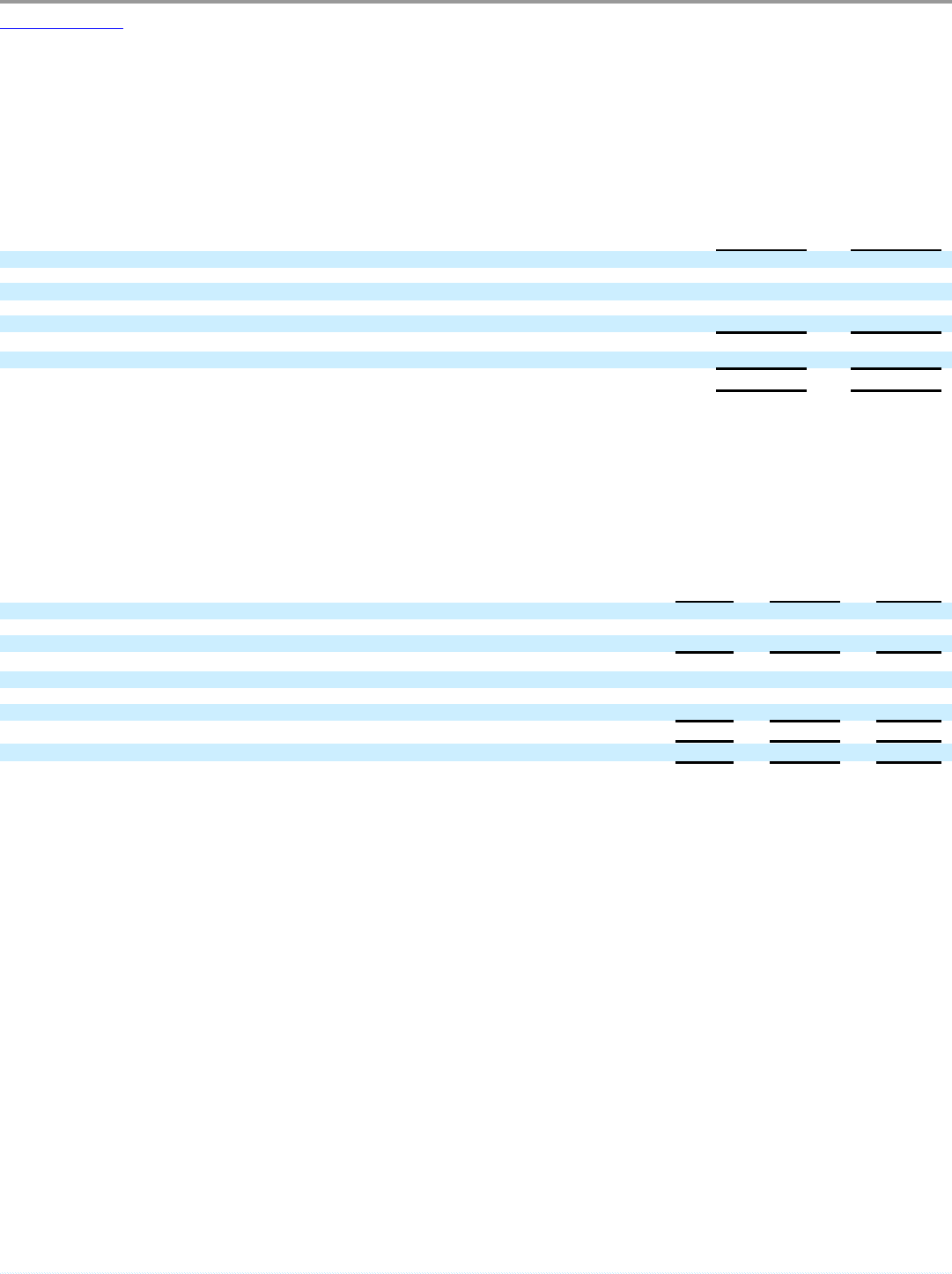

NOTE 4 — PROPERTY AND EQUIPMENT

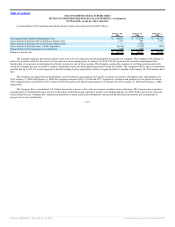

A summary of property and equipment is as follows:

January 30,

2010

January 31,

2009

(Revised)

Land and land improvements $ 174,551 $ 177,069

Buildings 585,860 594,578

Leasehold improvements 321,092 341,319

Fixtures and equipment 734,847 811,642

Construction in progress 10,921 24,968

1,827,271 1,949,576

Accumulated depreciation (871,189) (891,183)

$ 956,082 $ 1,058,393

Amounts above include gross assets recorded under capital leases for buildings and equipment of $126,511 and $4,436, respectively as of January 30,

2010 and January 31, 2009. Accumulated depreciation of assets recorded under capital leases was $106,335 and $102,871 as of January 30, 2010 and January 31,

2009, respectively.

Depreciation expense was $135,135, $134,669, and $131,710 in 2009, 2008, and 2007, respectively.

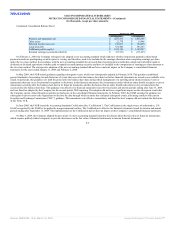

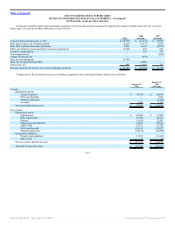

NOTE 5 — INCOME TAXES

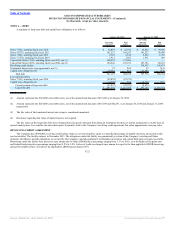

The components of income tax expense (benefit) from continuing operations were as follows:

2009

2008

(Revised)

2007

(Revised)

Current:

Federal $ (4,261) $ 1,717 $ 826

State 345 (839) 2,141

(3,916) 878 2,967

Deferred:

Federal (34,266) (51,177) 25,593

State (6,319) 1,397 (1,805)

(40,585) (49,780) 23,788

Total expense (benefit) from continuing operations $ (44,501) $ (48,902) $ 26,755

F-18

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠