Saks Fifth Avenue 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

Certain reclassifications were made to prior period amounts to conform to the current year presentation.

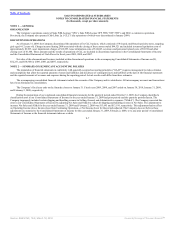

ADOPTION OF NEW ACCOUNTING PRONOUNCEMENTS

Effective February 1, 2009, the Company retrospectively adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) 470 related to accounting for convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement) (“ASC 470”).

In March 2004, the Company issued $230,000 of 2.00% convertible senior notes that mature in 2024 (the “2.0% Convertible Senior Notes”). The 2.0%

Convertible Senior Notes are within the scope of ASC 470, which requires an allocation of convertible debt proceeds between the liability component and the

embedded conversion option (i.e., the equity component). The liability component of the debt instrument is accreted to par value using the effective interest

method over the remaining life of the debt (the first put date in 2014). The accretion is reported as a component of interest expense. The equity component is not

subsequently revalued as long as it continues to qualify for equity treatment.

Upon adoption of ASC 470, the Company estimated the fair value, as of the date of issuance, of the 2.0% Convertible Senior Notes assuming a 6.25%

non-convertible borrowing rate to be $158,148. The difference between the fair value and the principal amount of the 2.0% Convertible Senior Notes was

$71,852. This amount was retrospectively recorded as a debt discount and as an increase to additional paid-in capital as of the issuance date. The discount is

being accreted to interest expense over the ten-year period to the first put date of the notes in 2014 resulting in an increase in non-cash interest expense in prior

and future periods.

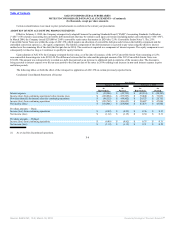

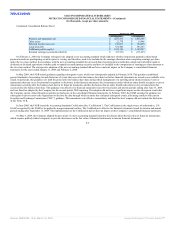

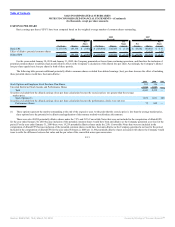

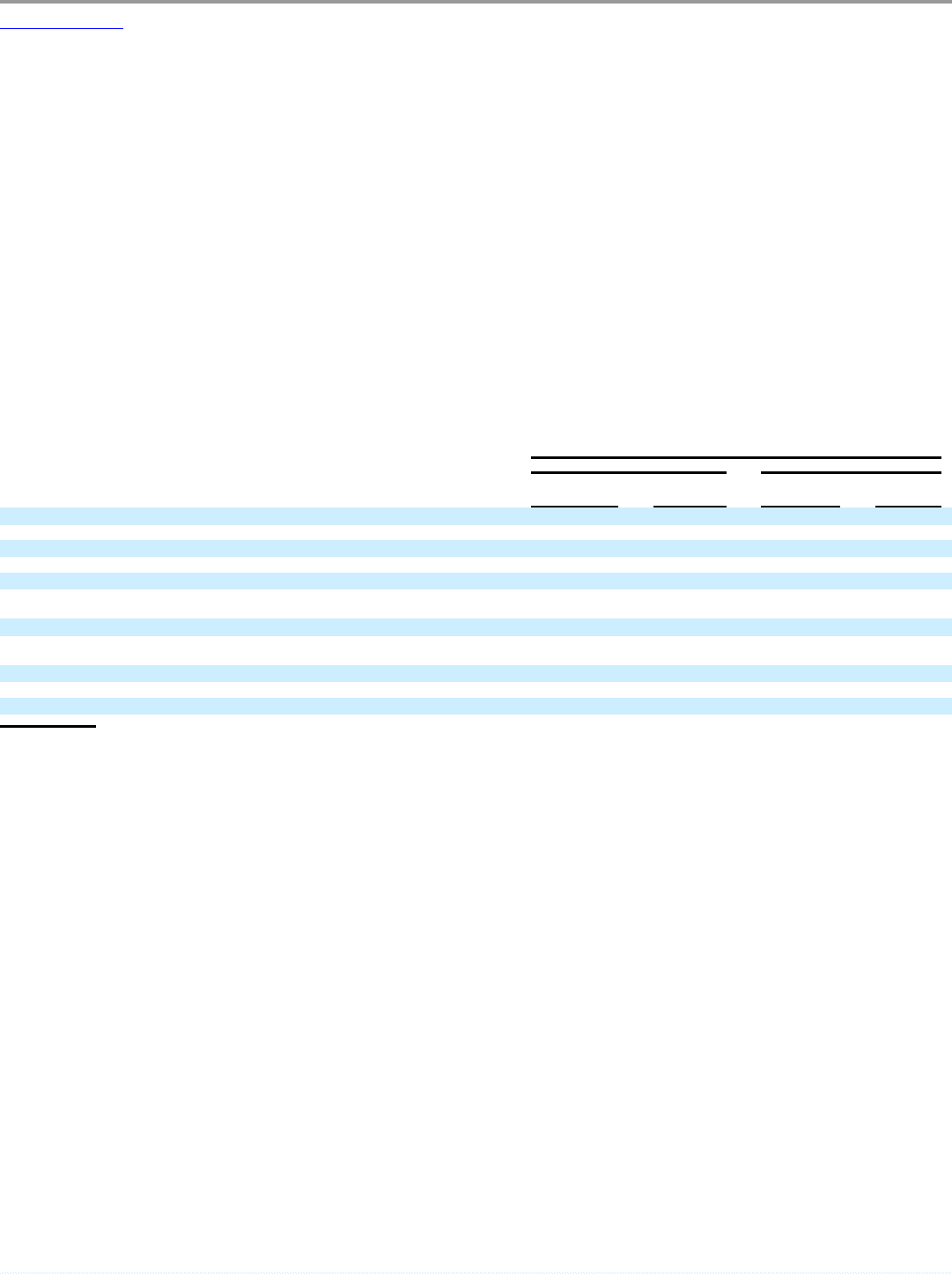

The following tables set forth the effect of the retrospective application of ASC 470 on certain previously reported items.

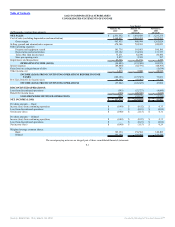

Condensed Consolidated Statements of Income:

Year Ended

January 31, 2009 February 2, 2008

As

Reported (1)

As

Revised

As

Reported (1)

As

Revised

Interest expense $ (39,306) $ (45,739) $ (42,314) $ (48,303)

Income (loss) from continuing operations before income taxes $ (169,094) $ (175,527) $ 79,840 $ 73,851

Provision (benefit) for income taxes for continuing operations $ (46,332) $ (48,902) $ 29,153 $ 26,755

Income (loss) from continuing operations $ (122,762) $ (126,625) $ 50,687 $ 47,096

Net income (loss) $ (154,941) $ (158,804) $ 47,473 $ 43,882

Per share amounts — Basic

Income (loss) from continuing operations $ (0.89) $ (0.92) $ 0.36 $ 0.33

Net income (loss) $ (1.12) $ (1.15) $ 0.34 $ 0.31

Per share amounts — Diluted

Income (loss) from continuing operations $ (0.89) $ (0.92) $ 0.33 $ 0.31

Net income (loss) $ (1.12) $ (1.15) $ 0.31 $ 0.29

(1) As revised for discontinued operations.

F-8

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠