Saks Fifth Avenue 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DISCONTINUED OPERATIONS

As of January 31, 2009, the Company discontinued the operations of its CLL business, which consisted of 98 leased, mall-based specialty stores, targeting

girls aged 4-12 years old. Charges incurred during 2008 associated with the closing of these stores totaled approximately $44.5 million and included inventory

liquidation costs of approximately $7.0 million, asset impairment charges of $17.0 million, lease termination costs of $14.0 million, severance and personnel

related costs of $5.1 million, and other closing costs of $1.4 million. These amounts are included in discontinued operations in the Consolidated Statement of

Income and the Consolidated Statement of Cash Flows for fiscal year 2008. The remaining amount payable related to the disposition of the CLL business as of

January 30, 2010 is $0.7 million and is expected to be paid during the year ending January 29, 2011.

SAKS FIFTH AVENUE NEW ORLEANS STORE

In late August 2005, the SFA store in New Orleans suffered substantial water, fire, and other damage related to Hurricane Katrina. The Company reopened

the store in the fourth fiscal quarter of 2006 after necessary repairs and renovations were made to the property.

The SFA New Orleans store was covered by both property damage and business interruption insurance. The property damage coverage paid to repair

and/or replace the physical property damage and inventory loss, and the business interruption coverage reimbursed the Company for lost profits as well as

continuing expenses related to loss mitigation, recovery, and reconstruction for the full duration of the reconstruction period plus three months. The Company

recorded in 2005 both (i) a $14.7 million gain on the excess of the replacement insurance value over the recorded net book value of the lost and damaged assets

and (ii) $2.6 million of expenses related to the insurance deductible. In 2006, the Company recorded an adjustment (credit) of $1.6 million related to the

insurance deductible. In 2007, the Company recorded a pre-tax gain of $13.5 million associated with the proceeds from the business interruption claims.

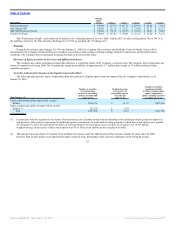

FINANCIAL PERFORMANCE SUMMARY

On a consolidated basis, total net sales and comparable store sales for the year ended January 30, 2010 decreased 13.5% and 14.7%, respectively. The

Company recorded a loss from continuing operations of $57.7 million, or $0.40 per share compared to a loss from continuing operations of $126.6 million, or

$0.92 per share, for the years ended January 30, 2010 and January 31, 2009, respectively. After recognition of the Company’s after-tax loss from discontinued

operations of $0.3 million, net loss totaled $57.9 million, or $0.40 per share for the year ended January 30, 2010. After recognition of the Company’s after-tax

loss from discontinued operations of $32.2 million, or $0.23 per share, net loss totaled $158.8 million, or $1.15 per share for the year ended January 31, 2009.

The year ended January 30, 2010 included net after tax charges totaling $10.4 million or $0.07 per share, primarily related to $17.3 million or $0.12 per

share of asset impairment charges incurred in the normal course of business and a $3.1 million or $0.02 per share non-cash pension charge related to excess lump

sum distributions during 2009 primarily resulting from the Company’s 2009 reductions-in-force. The year ended January 30, 2010 also included a net gain of

$10.0 million or $0.07 per share, related to federal and state tax adjustments.

The year ended January 31, 2009 included net after-tax charges totaling $26.2 million or $0.19 per share, primarily related to $7.0 million or $0.05 per

share of asset impairment charges incurred in the normal course of business and approximately $6.7 million or $0.05 per share of severance costs related to the

Company’s 2008 downsizing initiative and the Ft. Lauderdale store closing. The year ended January 31, 2009 also included a write-off and adjustment of $14.6

million or $0.11 per share of certain deferred tax assets primarily associated with federal net operating loss (“NOL”) tax credits that expired at the end of fiscal

2008. These expenses were partially offset by a net gain of $2.1 million or $0.02 per share related to the sale of three unutilized properties.

23

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠