Saks Fifth Avenue 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

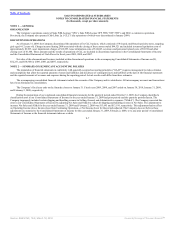

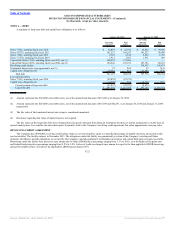

OPERATING LEASES

The Company leases stores, distribution centers, and administrative facilities under operating leases. Store lease agreements generally include rent

holidays, rent escalation clauses and contingent rent provisions for percentage of sales in excess of specified levels. Most of the Company’s lease agreements

include renewal periods at the Company’s option. The Company recognizes rent holiday periods and scheduled rent increases on a straight-line basis over the

lease term beginning with the date the Company takes possession of the leased space and includes such rent expense in Store Pre-Opening Costs. The Company

records tenant improvement allowances and rent holidays as deferred rent liabilities on the consolidated balance sheets and amortizes the deferred rent on a

straight–line basis over the life of the lease to rent expense in the Consolidated Statements of Income. The Company records rent liabilities on the consolidated

balance sheets for contingent percentage of sales lease provisions when the Company determines that it is probable that the specified levels will be reached

during the fiscal year.

SELF-INSURANCE RESERVES

The Company self-insures a substantial portion of its exposure for costs related primarily to employee medical, workers’ compensation and general

liability. Expenses are recorded based on estimates for reported and incurred but not reported claims considering a number of factors, including historical claims

experience, severity factors, litigation costs, inflation and other assumptions. Although the Company does not expect the amount it will ultimately pay to differ

significantly from its estimates, self-insurance reserves could be affected if future claims experience differs significantly from the historical trends and

assumptions.

STOCK-BASED COMPENSATION PLANS

The Company maintains an equity incentive plan for the granting of options, stock appreciation rights, performance shares, restricted stock, and other

forms of equity awards to employees and directors. Options granted generally vest over a four-year period after grant and have an exercise term of seven to ten

years from the grant date. Restricted stock and performance shares generally vest in three years after the grant date, although the plan permits accelerated vesting

in certain circumstances at the discretion of the Human Resources and Compensation Committee of the Board of Directors (“HRCC”).

Compensation costs for restricted stock and performance shares that cliff vest is expensed on a straight line basis over the requisite service period. Restricted

stock and performance shares with graded vesting features are treated as multiple awards based upon the vesting date. The Company records compensation costs

for these awards on a straight line basis over the requisite service period for each separately vesting portion of the award. Compensation costs for stock option

awards with graded vesting are expensed on a straight line basis over the requisite service period.

F-14

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠