Saks Fifth Avenue 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

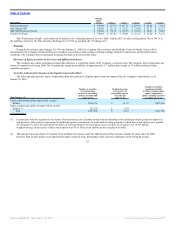

The year ended February 2, 2008 included net after-tax charges totaling $16.0 million, or $0.10 per share, primarily related to $18.1 million, or $0.12 per

share, for retention, severance, and transition costs related to the Company’s downsizing and consolidation following the disposition of its Saks Department Store

Group (“SDSG”) businesses. Additionally, legal and investigation costs totaled $3.7 million, or $.02 per share, associated with the previously disclosed

investigation by the SEC (which has been concluded) and the investigation by the Office of the United States Attorney for the Southern District of New York as

well as the settlement of two related vendor lawsuits. The year ended February 2, 2008 also included a loss on extinguishment of debt totaling $3.4 million or

$.02 per share, related to the repurchase of $106.3 million of senior notes, $2.7 million, or $.02 per share, related to asset impairments and dispositions, and $0.8

million expense related to a state tax adjustment. These expenses were partially offset by an insurance adjustment (credit) of $8.1 million, or $0.05 per share,

related to the New Orleans Store, as well as a gain of $1.6 million, or $.01 per share, related to an OFF 5TH store closing and the sale of an unused support

facility. Lastly, there was a $3.0 million, or $.02 per share, state income tax valuation adjustment (credit).

During the preparation of our condensed consolidated financial statements for the quarterly period ended October 31, 2009, the Company identified a

classification error in our Consolidated Statements of Income for the year ended January 31, 2009 and prior periods and the quarterly periods therein. The

Company improperly included certain shipping and handling revenue in selling, general and administrative expenses (“SG&A”). The Company corrected this

error in the Consolidated Statements of Income by adjusting Net Sales and SG&A to reflect all shipping and handling revenue in Net Sales for all prior periods

presented.

Effective February 1, 2009, the Company retrospectively adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) 470 related to accounting for convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement) (“ASC 470”),

which requires an allocation of convertible debt proceeds between the liability component and the embedded conversion option (i.e., the equity component). The

liability component of the debt instrument is accreted to par value using the effective interest method over the remaining life of the debt. The accretion is reported

as a component of interest expense. The equity component is not subsequently revalued as long as it continues to qualify for equity treatment.

The Company believes that an understanding of its reported financial condition and results of operations is not complete without considering the effect of

all other components of MD&A included herein.

24

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠