Saks Fifth Avenue 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

RESULTS OF OPERATIONS

The following table sets forth, for the periods indicated, selected items from the Company’s Consolidated Statements of Income, expressed as percentages

of net sales (numbers may not total due to rounding):

Year Ended

January 30,

2010

January 31,

2009

(Revised)

February 2,

2008

(Revised)

Net sales 100% 100% 100%

Cost of sales (excluding depreciation and amortization) 63.4 67.8 60.9

Gross margin 36.6 32.2 39.1

Selling, general and administrative expenses 25.6 25.8 26.0

Other operating expenses 12.0 10.5 9.8

Impairments and dispositions 1.1 0.4 0.1

Operating income (loss) (2.1) (4.4) 3.2

Interest expense (1.9) (1.5) (1.5)

Gain (loss) on extinguishment of debt 0.0 0.0 (0.2)

Other income, net 0.0 0.2 0.8

Income (loss) from continuing operations before income taxes (3.9) (5.8) 2.3

Provision (benefit) for income taxes (1.7) (1.6) 0.8

Income (loss) from continuing operations (2.2) (4.2) 1.5

Discontinued operations:

Loss from discontinued operations (0.0) (1.7) (0.2)

Benefit for income taxes (0.0) (0.7) (0.1)

Loss from discontinued operations (0.0) (1.1) (0.1)

Net income (loss) (2.2)% (5.2)% 1.4%

FISCAL YEAR ENDED JANUARY 30, 2010 (“2009”) COMPARED TO FISCAL YEAR ENDED JANUARY 31, 2009 (“2008”)

DISCUSSION OF OPERATING LOSS — CONTINUING OPERATIONS

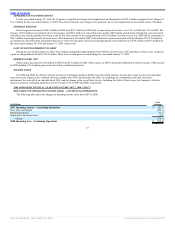

The following table shows the changes in operating loss from 2008 to 2009:

(In Millions)

Total

Company

2008 Operating Loss—Continuing Operations $ (135.4)

Store sales and margin (17.5)

Operating expenses 116.6

Impairments and dispositions (18.2)

Change 80.9

2009 Operating Loss—Continuing Operations $ (54.5)

For the year ended January 30, 2010, the Company’s operating loss totaled $54.5 million, a 240 basis point improvement as a percentage of net sales from

the operating loss of $135.4 million in the same period last year. The current operating loss was driven by a 14.7% decrease in comparable store sales partially

offset by a gross margin rate increase of 440 basis points for the year ended January 30, 2010. The increase in the gross margin

25

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠