Saks Fifth Avenue 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

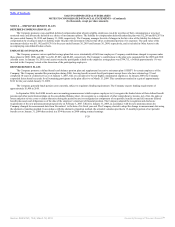

approximately $52,231 million for 2008 and was not profitable. The Company incurred charges of $44,521 in 2008 associated with the CLL store closings which

are included in discontinued operations in the Consolidated Statements of Income.

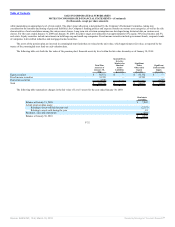

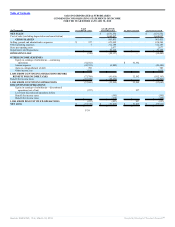

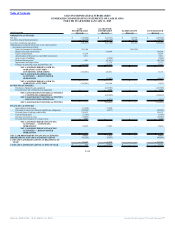

The following table summarizes 2009 activity related to the discontinuation of the CLL business:

Severance and

Personnel

Related Costs

Lease

Termination

Costs

Other

Closing Costs Total

Balance at January 31, 2009 $ 3,651 $ 9,780 $ 172 $ 13,603

Adjustments to the reserve — 156 — 156

Cash Payments (3,651) (9,234) (172) (13,057)

Balance at January 30, 2010 $ — $ 702 $ — $ 702

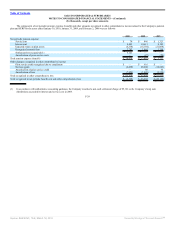

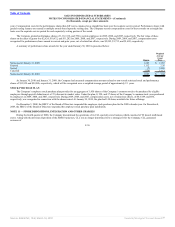

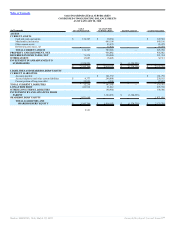

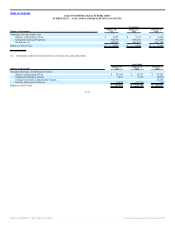

NOTE 12 — QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

Summarized quarterly financial information for 2009 and 2008 is as follows:

First

Quarter

(Revised)

Second

Quarter

(Revised)

Third

Quarter

Fourth

Quarter

Fiscal year ended January 30, 2010:

Total sales $ 624,265 $ 564,519 $ 631,434 $ 811,314

Gross margin 241,407 170,999 254,635 296,394

Operating income (loss) 2,191 (67,688) 15,609 (4,597)

Income (loss) from continuing operations (4,881) (54,489) 6,333 (4,625)

Net income (loss) (5,117) (54,512) 6,318 (4,608)

Basic earnings (loss) per common share $ (0.04) $ (0.39) $ 0.04 $ (0.03)

Diluted earnings (loss) per common share $ (0.04) $ (0.39) $ 0.04 $ (0.03)

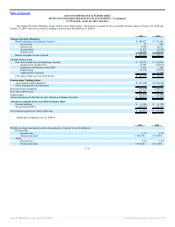

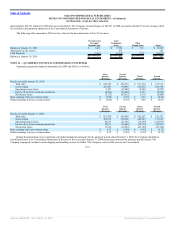

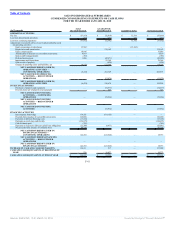

First

Quarter

(Revised)

Second

Quarter

(Revised)

Third

Quarter

(Revised)

Fourth

Quarter

(Revised)

Fiscal year ended January 31, 2009:

Total sales $ 853,470 $ 660,089 $ 690,297 $ 839,582

Gross margin 326,272 230,528 246,329 177,815

Operating income (loss) 42,614 (41,566) (14,369) (122,067)

Income (loss) from continuing operations 18,971 (30,906) (30,793) (83,897)

Net income (loss) 17,336 (32,667) (43,729) (99,744)

Basic earnings (loss) per common share $ 0.12 $ (0.24) $ (0.32) $ (0.72)

Diluted earnings (loss) per common share $ 0.12 $ (0.24) $ (0.32) $ (0.72)

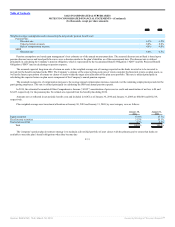

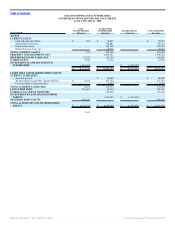

During the preparation of our condensed consolidated financial statements for the quarterly period ended October 31, 2009, the Company identified a

classification error in its Consolidated Statements of Income for the year ended January 31, 2009 and prior periods and the quarterly periods therein. The

Company improperly included certain shipping and handling revenue in SG&A. The Company corrected this error in our Consolidated

F-37

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠