Saks Fifth Avenue 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

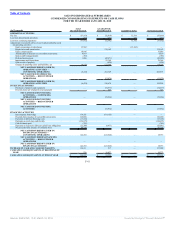

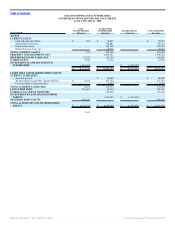

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

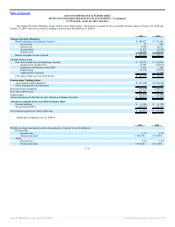

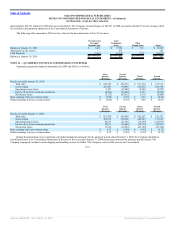

At January 30, 2010, the following pension plan and SERP benefit payments are expected to be paid:

Year

Benefit

Payments

2010 $ 18,768

2011 16,377

2012 15,605

2013 15,354

2014 15,152

2015 - 2019 49,490

$ 130,746

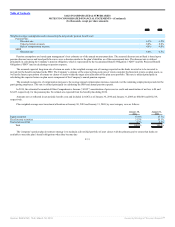

NOTE 9 — SHAREHOLDERS’ EQUITY

The Company has a share repurchase program that authorizes it to purchase shares of the Company’s common stock. There were no shares repurchased

during 2009. During 2008 and 2007, the Company repurchased 2,949 and 1,722 shares for an aggregate amount of $34,899 and $27,464, respectively. There

were 32,709 shares available for repurchase under the share repurchase program at January 30, 2010.

On July 30, 2009, the Company filed a universal shelf registration statement with the SEC permitting the Company to issue securities, in one or more

offerings, with a maximum aggregate offering price of $400,000. The shelf registration statement covers a variety of securities including common stock,

preferred stock, warrants, and debt securities.

Under the universal shelf registration, the Company completed the public offering of approximately 14,925 shares of its common stock on October 6,

2009, at an offering price of $6.70 per share for $95,095 in proceeds, net of issuance costs.

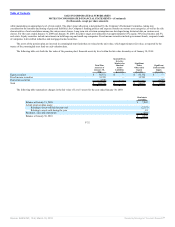

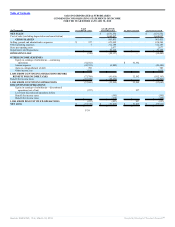

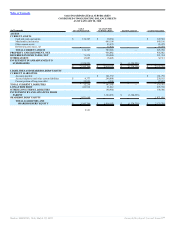

NOTE 10 — EMPLOYEE STOCK PLANS

The Company maintains an equity incentive plan for the granting of options, stock appreciation rights, performance shares, restricted stock and other

forms of equity awards to employees and directors. At January 30, 2010 and January 31, 2009, the Company had available for grant 6,028 and 16,061 shares of

common stock, respectively. Options granted generally vest over a four-year period after grant and have an exercise term of seven to ten years from the grant

date. Restricted stock and performance shares generally vest three years after the grant date, although the plan permits accelerated vesting in certain

circumstances at the discretion of the HRCC of the Board of Directors.

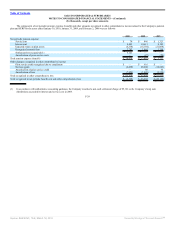

Total pre-tax stock-based compensation expense for the years ended January 30, 2010, January 31, 2009, and February 2, 2008 was $16,846, $16,354, and,

$7,724, respectively. The related tax benefit for the years ended January 30, 2010, January 31, 2009, and February 2, 2008 was $6,570, $6,542, and $3,090,

respectively.

F-33

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠