Saks Fifth Avenue 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

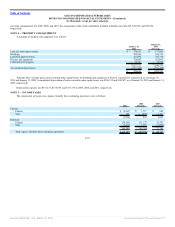

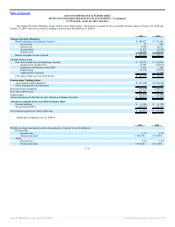

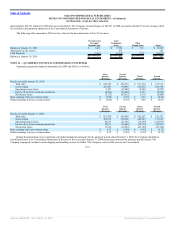

NOTE 8 — EMPLOYEE BENEFIT PLANS

DEFERRED COMPENSATION PLAN

The Company sponsors a non-qualified deferred compensation plan wherein eligible employees can defer a portion of their compensation or unvested

restricted stock and allocate the deferrals to a choice of investments options. The liability for compensation deferred under this plan was $12,266 and $10,267 for

the years ended January 30, 2010 and January 31, 2009, respectively. The Company manages the risk of changes in the fair value of the liability for deferred

compensation by electing to match its liability under the plan with investment vehicles that offset a substantial portion of its exposure. The cash value of the

investment vehicles was $11,962 and $9,701 for the years ended January 30, 2010 and January 30, 2009, respectively, and is included in Other Assets in the

accompanying consolidated balance sheets.

EMPLOYEE SAVINGS PLANS

The Company sponsors various qualified savings plans that cover substantially all full-time employees. Company contributions charged to expense under

these plans for 2009, 2008, and 2007 were $0, $7,805, and $8,403, respectively. The Company’s contributions to the plan were suspended for the 2009 and 2010

calendar years. At January 30, 2010, total assets invested by participants related to the employee savings plans was $394,715, of which approximately 1% was

invested in the Company’s stock at the discretion of the participating employees.

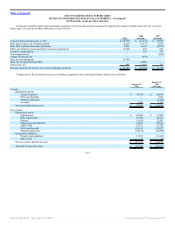

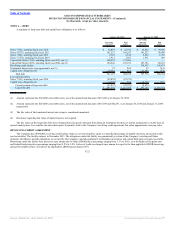

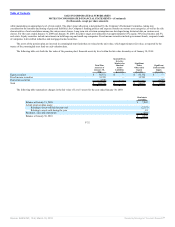

DEFINED BENEFIT PLANS

The Company sponsors a defined benefit cash balance pension plan and supplemental executive retirement plan (“SERP”) for certain employees of the

Company. The Company amended the pension plan during 2006, freezing benefit accruals for all participants except those who have attained age 55 and

completed 10 years of credited service as of January 1, 2007, who are considered to be non-highly compensated employees. In January 2009, the Company

suspended future benefit accruals for all remaining participants in the plan effective on March 13, 2009. This curtailment resulted in a gain of approximately

$616 for the year ended January 31, 2009.

The Company generally funds pension costs currently, subject to regulatory funding requirements. The Company expects funding requirements of

approximately $1,400 in 2010.

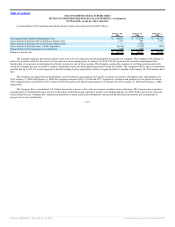

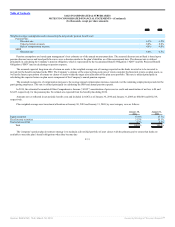

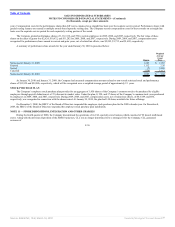

In September 2006, the FASB issued a new accounting pronouncement which requires employers to (i) recognize the funded status of their defined benefit

pension and other postretirement plans on the consolidated balance sheet, (ii) recognize as a component of other comprehensive income, net of tax, the gains or

losses and prior service costs or credits that arise during the period but are not recognized as components of net periodic benefit cost and (iii) measure defined

benefit plan assets and obligations as of the date of the employer’s statement of financial position. The Company adopted the recognition and disclosure

requirements of the new pronouncement prospectively on February 3, 2007. Effective January 31, 2009, in accordance with the new pronouncement, the

Company changed its measurement date from November 1 to the date of its fiscal year end. The Company elected to adopt the change in measurement date using

the alternative transition method. In accordance with the alternative transition method, the actuarial valuation provided a 15-month projection of net periodic

benefit cost to January 31, 2009 that resulted in a $344 decrease to 2008 ending retained earnings.

F-28

Source: SAKS INC, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠