Radio Shack 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Amounts in the other category reflect our business activities that are not separately reportable, which

include our dealer network, e-commerce, third-party service centers, manufacturing and foreign

operations.

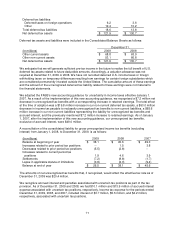

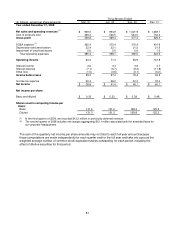

(In millions) Year Ended December 31,

2009 2008 2007

Net sales and operating revenues:

U.S. RadioShack company-operated stores $ 3,650.9 $ 3,611.1 $ 3,637.7

Kiosks 250.0 283.5 297.0

Other (1) 375.1 329.9 317.0

$ 4,276.0 $ 4,224.5 $ 4,251.7

Operating income:

U.S. RadioShack company-operated stores (2) (3) $ 702.8 $ 716.4 $ 780.9

Kiosks (4) 15.4 8.4 15.8

Other (1) (5) 39.9 44.1 52.8

758.1 768.9 849.5

Unallocated (2) (6) (7) (388.7) (446.7) (467.6)

Operating income 369.4 322.2 381.9

Interest income 4.8 14.6 22.6

Interest expense (44.1) (34.9) (38.8)

Other (loss) income (1.6) (2.4) 0.9

Income before income taxes $ 328.5 $ 299.5 $ 366.6

Depreciation and amortization:

U.S. RadioShack company-operated stores $ 45.8 $ 52.9 $ 53.4

Kiosks 3.2 5.8 6.3

Other 5.8 1.8 1.7

54.8 60.5 61.4

Unallocated (8) 38.1 38.6 51.3

$ 92.9 $ 99.1 $ 112.7

(1) Net sales and operating revenues and operating income for 2009 include the consolidation of our Mexican

subsidiary.

(2) Amounts have been retrospectively adjusted to conform to current year presentations. Certain prior year inter-

company amounts have been reallocated between the segment and the unallocated category.

(3) Operating income for 2007 includes an $18.8 million federal excise tax refund and an accrued vacation reduction

of $11.0 million in connection with the modification of our employee vacation policy.

(4) Operating income for 2007 includes $1.1 million in connection with the modification of our employee vacation

policy.

(5) Operating income for 2007 includes an accrued vacation reduction of $1.3 million in connection with the

modification of our employee vacation policy.

(6) The unallocated category included in operating income relates to our overhead and corporate expenses that are

not allocated to our operating segments for management reporting purposes. Unallocated costs include

corporate departmental expenses such as labor and benefits, as well as advertising, insurance, distribution and

information technology costs plus certain unusual or infrequent gains or losses.

(7) Unallocated operating income for 2008 includes net charges aggregating $12.1 million associated with the

amended lease for our corporate headquarters.

(8) Depreciation and amortization included in the unallocated category primarily relate to our information technology

assets.