Radio Shack 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

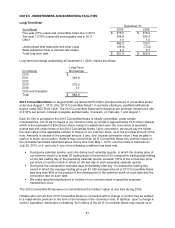

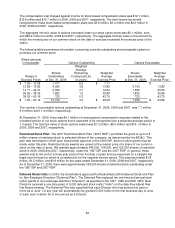

Deferred tax liabilities:

Deferred taxes on foreign operations 6.2 3.6

Other 12.4 10.2

Total deferred tax liabilities 18.6 13.8

Net deferred tax assets $ 121.9 $ 130.7

Deferred tax assets and liabilities were included in the Consolidated Balance Sheets as follows:

December 31,

(In millions) 2009 2008

Other current assets $ 68.8 $ 63.9

Other non-current assets 53.1 66.8

Net deferred tax assets $ 121.9 $ 130.7

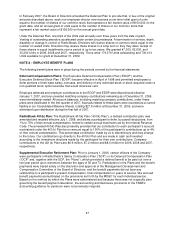

We anticipate that we will generate sufficient pre-tax income in the future to realize the full benefit of U.S.

deferred tax assets related to future deductible amounts. Accordingly, a valuation allowance was not

required at December 31, 2009 or 2008. We have not recorded deferred U.S. income taxes or foreign

withholding taxes on temporary differences resulting from earnings for certain foreign subsidiaries which

are considered permanently invested outside the United States. The cumulative amount of these earnings

and the amount of the unrecognized deferred tax liability related to these earnings were not material to

the financial statements.

We adopted the FASB’s new accounting guidance for uncertainty in income taxes effective January 1,

2007. As a result of the implementation of this new accounting guidance, we recognized a $7.2 million net

decrease in unrecognized tax benefits with a corresponding increase in retained earnings. The total effect

at the time of adoption was a $19.8 million increase in our non-current deferred tax assets, a $53.0 million

decrease in income tax payable to reclassify unrecognized tax benefits to non-current liabilities, a $65.6

million increase in our non-current liabilities representing the liability for unrecognized tax benefits and

accrued interest, and the previously mentioned $7.2 million increase to retained earnings. As of January

1, 2007, after the implementation of this new accounting guidance, our unrecognized tax benefits,

exclusive of accrued interest, were $49.0 million.

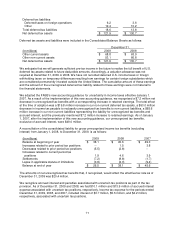

A reconciliation of the consolidated liability for gross unrecognized income tax benefits (excluding

interest) from January 1, 2008, to December 31, 2009, is as follows:

(In millions) 2009 2008 2007

Balance at beginning of year $ 38.1 $ 45.6 $ 49.0

Increases related to prior period tax positions -- 1.5 3.8

Decreases related to prior period tax positions (5.5) (2.8) --

Increases related to current period tax

positions

1.9

4.6

3.9

Settlements (7.2) (8.8) (1.7)

Lapse in applicable statute of limitations (0.8) (2.0) (9.4)

Balance at end of year $ 26.5 $ 38.1 $ 45.6

The amounts of net unrecognized tax benefits that, if recognized, would affect the effective tax rate as of

December 31, 2009 was $20.4 million.

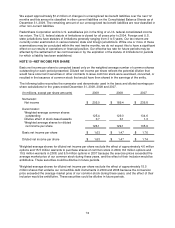

We recognize accrued interest and penalties associated with uncertain tax positions as part of the tax

provision. As of December 31, 2009 and 2008, we had $10.1 million and $13.9 million of accrued interest

expense associated with uncertain tax positions, respectively. Income tax expense for the periods ended

December 31, 2009, 2008, and 2007, included interest of $3.7 million, $5.5 million, and $4.2 million,

respectively, associated with uncertain tax positions.