Radio Shack 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

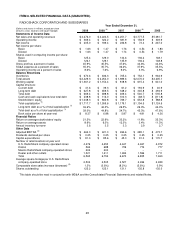

Rent expense decreased primarily due to lower rent expense associated with our corporate headquarters

for the second half of 2008. See above for further discussion.

The decrease in other taxes was partially driven by reduced payroll taxes associated with the decreased

compensation expense. Additionally, we recorded an $8.2 million sales and use tax benefit from the

settlement of a sales tax issue.

The increase in other SG&A was primarily due to a $12.1 million non-cash charge recorded in connection

with our amended headquarters lease in 2008 as previously discussed.

Depreciation and Amortization

Total depreciation and amortization for 2008 declined $13.6 million or 12.1%. This decrease was primarily

due to reduced capital expenditures in 2006 and 2007 when compared with prior years.

Impairment of Long-Lived Assets

Impairment of long-lived assets and other charges was $2.8 million and $2.7 million for 2008 and 2007,

respectively. These amounts were related primarily to our Sprint-branded kiosk operations and

underperforming U.S. RadioShack company-operated stores. We recorded this amount based on the

remaining estimated future cash flows related to these specific stores. It was determined that the net book

value of many of the stores' long-lived assets was not recoverable. For the stores with insufficient estimated

cash flows, we wrote down the associated long-lived assets to their estimated fair value.

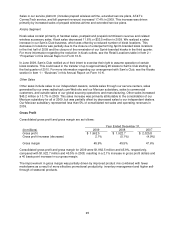

Net Interest Expense

Consolidated interest expense, net of interest income, was $20.3 million for 2008 versus $16.2 million for

2007, an increase of $4.1 million or 25.3%.

Interest expense decreased $3.9 million to $34.9 million in 2008 from $38.8 million in 2007. This

decrease was primarily attributable to lower interest rates on our floating rate debt exposure resulting

from our interest rate swaps, but was partially offset by additional interest expense related to our 2013

convertible notes.

Interest income decreased $8.0 million to $14.6 million in 2008 from $22.6 million in 2007. This decrease

was primarily due to a lower interest rate environment. Additionally, we recorded interest income related

to the federal telecommunications excise tax refunds of $0.5 million in 2008 and $1.4 million in 2007.

Other (Loss) Income

During 2008 we recorded a loss of $2.4 million compared with income of $0.9 million in 2007. These

amounts represent unrealized losses and gains related to our derivative exposure to Sirius XM Radio,

Inc. warrants as a result of our fair value measurements of these warrants. At December 31, 2008, the fair

value of these warrants was zero.

Income Tax Expense

Our effective tax rate for 2008 was 36.8% compared with 35.4% for 2007. The 2008 effective tax rate was

affected by the execution of a closing agreement with respect to a Puerto Rico income tax issue during

the year, which resulted in a credit to income tax expense; this discrete item lowered the effective tax rate

for 2008 by 1.0 percentage point. In addition, the 2008 effective tax rate was affected by the net reversal

of approximately $4.1 million in unrecognized tax benefits, deferred tax assets and accrued interest

related to the settlement of various state income tax issues and the expiration of the statute of limitations

with respect to our 2002 taxable year; this net reversal lowered the effective tax rate for 2008 by 1.4

percentage points.