Radio Shack 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

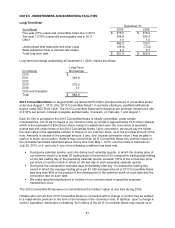

repurchase for cash all or any portion of their 2013 Convertible Notes for 100% of the principal amount of

the notes plus accrued and unpaid interest, if any. As of December 31, 2009, none of the conditions

allowing holders of the 2013 Convertible Notes to convert or requiring us to repurchase the 2013

Convertible Notes had been met.

In connection with the issuance of the 2013 Convertible Notes, we entered into separate convertible note

hedge transactions and separate warrant transactions with respect to our common stock to reduce the

potential dilution upon conversion of the 2013 Convertible Notes (collectively referred to as the “Call

Spread Transactions”). The convertible note hedges and warrants will generally have the effect of

increasing the economic conversion price of the 2013 Convertible Notes to $36.60 per share of our

common stock, representing a 100% conversion premium based on the closing price of our common

stock on August 12, 2008. See Note 6 - “Stockholders’ Equity,” for more information on the Call Spread

Transactions.

Because the principal amount of the 2013 Convertible Notes will be settled in cash upon conversion, the

2013 Convertible Notes will only affect diluted earnings per share when the price of our common stock

exceeds the conversion price (initially $24.25 per share). We will include the effect of the additional

shares that may be issued from conversion in our diluted net income per share calculation using the

treasury stock method.

Application of the FASB’s New Accounting Guidance: On January 1, 2009, as a result of adopting the

new accounting guidance related to the accounting for convertible debt instruments that may be settled in

cash upon conversion, we recorded an adjustment to reduce the carrying value of our 2013 Convertible

Notes by $73.0 million. The adoption resulted in a carrying amount for the 2013 Convertible Notes of

$302.0 million at December 31, 2008. The carrying amount for the equity component is $78.0 million. The

adjustment to the carrying value of the 2013 Convertible Notes was based on the calculated fair value of

a similar debt instrument in August 2008 (at issuance) that does not have an associated equity

component. The annual interest rate calculated for a similar debt instrument in August 2008 was 7.6%.

The resulting discount is being amortized to interest expense over the remaining term of the convertible

notes. The carrying value of the 2013 Convertible Notes was $315.8 million and $302.0 million at

December 31, 2009 and 2008, respectively. We recognized interest expense of $9.4 million and $3.5

million in 2009 and 2008, respectively, related to the stated 2.50% coupon. We recognized non-cash

interest expense of $13.8 million and $5.0 million in 2009 and 2008, respectively, for the amortization of

the discount on the liability component.

Debt issuance costs of $7.5 million were capitalized and are being amortized to interest expense over the

term of the 2013 Convertible Notes. Unamortized debt issuance costs were $5.3 million at December 31,

2009. Debt issuance costs of $1.9 million were related to the equity component and were recorded as a

reduction of additional paid-in capital.

For federal income tax purposes, the issuance of the 2013 Convertible Notes and the purchase of the

convertible note hedges are treated as a single transaction whereby we are considered to have issued

debt with an original issue discount. The amortization of this discount in future periods is deductible for

tax purposes. Therefore, upon issuance of the debt, we recorded an adjustment to increase our deferred

tax assets (included in other assets, net) and additional paid-in capital for these future tax deductions.

Upon adoption of the new accounting guidance in the first quarter of 2009, this adjustment was reduced

by $27.8 million because our recorded interest expense for book purposes more closely aligns with

federal tax treatment.

2011 Long-Term Notes: On May 11, 2001, we issued $350 million of 10-year 7.375% notes (“2011

Notes”) in a private offering to qualified institutional buyers under SEC Rule 144A. In August 2001, under

the terms of an exchange offering filed with the SEC, we exchanged substantially all of these notes for a

similar amount of publicly registered notes. The exchange resulted in substantially all of the notes

becoming registered with the SEC and did not result in additional debt being issued.

The annual interest rate on the notes is 7.375% per annum, with interest payable on November 15 and

May 15 of each year. The notes contain certain non-financial covenants and mature on May 15, 2011. In