Radio Shack 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

Effect if actual results differ from assumptions

We have not made any material changes in the accounting methodologies used to record stock-based

compensation during the past three years. While the assumptions that we develop are based on our best

expectations, they involve inherent uncertainties based on market conditions and employee behavior that

are outside of our control. If actual results are not consistent with the assumptions used, the stock-based

compensation expense reported in our financial statements may not be representative of the actual

economic cost of the stock-based compensation. Additionally, if actual employee forfeitures significantly

differ from our estimated forfeitures, we may have an adjustment to our financial statements in future

periods. A 10% change in our stock-based compensation expense in 2009 would have affected our net

income by approximately $1.2 million.

FACTORS THAT MAY AFFECT FUTURE RESULTS

Matters discussed in MD&A and in other parts of this report include forward-looking statements within the

meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements

are statements that are not historical and may be identified by the use of words such as “expect,”

“believe,” “anticipate,” “estimate,” “intend,” “potential” or similar words. These matters include statements

concerning management’s plans and objectives relating to our operations or economic performance and

related assumptions. We specifically disclaim any duty to update any of the information set forth in this

report, including any forward-looking statements. Forward-looking statements are made based on

management’s current expectations and beliefs concerning future events and, therefore, involve a

number of assumptions, risks and uncertainties, including the risk factors described in Item 1A, “Risk

Factors,” of this Annual Report on Form 10-K. Management cautions that forward-looking statements are

not guarantees, and our actual results could differ materially from those expressed or implied in the

forward-looking statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

At December 31, 2009, the only derivative instruments that materially increased our exposure to market

risks for interest rates, foreign currency rates, commodity prices or other market price risks were interest

rate swaps, which serve as an economic hedge on our long-term debt. We do not use derivatives for

speculative purposes. Refer to Note 11 – “Derivative Financial Instruments” in Notes to Consolidated

Financial Statements of this Annual Report on Form 10-K for additional information.

Our exposure to interest rate risk results from changes in short-term interest rates. Interest rate risk exists

with respect to our net investment position at December 31, 2009, of $670.5 million, consisting of

fluctuating short-term investments of $820.5 million and offset by $150 million of indebtedness which,

because of our interest rate swaps, effectively bears interest at short-term floating rates. A hypothetical

increase or decrease of 100 basis points in the interest rate applicable to this floating-rate net exposure

would result in a change in annual net interest expense of $6.7 million and an approximate $2.3 million

change to the fair value of our interest rate swaps, which would also affect net interest expense. This

hypothesis assumes no change in the principal or investment balance.

We have market risk arising from changes in foreign currency exchange rates related to our purchase of

inventory from manufacturers located in China and other areas outside of the U.S. Our purchases are

denominated in U.S. dollars; however, the strengthening of the Chinese currency, or other currencies,

against the U.S. dollar could cause our vendors to increase the prices of items we purchase from them. It

is not possible to estimate the effect of foreign currency exchange rate changes on our purchases of this

inventory. We are also exposed to foreign currency fluctuations related to our Mexican subsidiary, which

represented less than 5% of consolidated net sales and operating revenues in 2009.

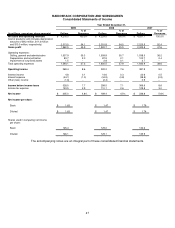

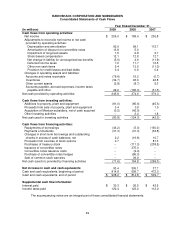

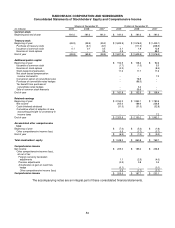

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The Index to our Consolidated Financial Statements is found on page 45. Our Consolidated Financial

Statements and Notes to Consolidated Financial Statements follow the index.