Radio Shack 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

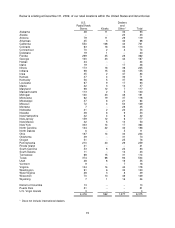

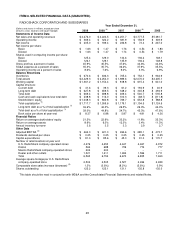

(1) Capitalization is defined as total debt plus total stockholders' equity.

(2) Adjusted EBITDA, a non-GAAP financial measure, is defined as earnings before interest, taxes, depreciation and

amortization. Our calculation of adjusted EBITDA is also adjusted for other (loss) income and cumulative effect of change

in accounting principle. The comparable financial measure to adjusted EBITDA under GAAP is net income. Adjusted

EBITDA is used by management to evaluate the operating performance of our business for comparable periods and is a

metric used in the computation of annual and long-term incentive management bonuses. Adjusted EBITDA should not be

used by investors or others as the sole basis for formulating investment decisions as it excludes a number of important

items. We compensate for this limitation by using GAAP financial measures as well in managing our business. In the view

of management, adjusted EBITDA is an important indicator of operating performance because adjusted EBITDA excludes

the effects of financing and investing activities by eliminating the effects of interest and depreciation costs.

(3) Comparable store sales include the sales of U.S. RadioShack company-operated stores and kiosks with more than 12 full

months of recorded sales. Following the termination of the Sprint-branded kiosk business, these former Sprint-branded

kiosks were transformed into multiple wireless carrier RadioShack-branded locations. We managed and reported 111 of

these locations as extensions of existing RadioShack company-operated stores located in the same shopping malls at

December 31, 2009; current year results of such kiosks are included with these RadioShack company-operated stores for

purposes of comparable store sales. For more information regarding the transition of the Sprint-branded kiosks to

RadioShack-branded locations, see Item 1 – “Business” in this Annual Report on Form 10-K.

(4) Due to our adoption of the FASB’s new rules regarding accounting for convertible debt, certain 2008 amounts have been

adjusted from the amounts included in our Annual Report on Form 10-K for the year ended December 31, 2008. Refer to

Note 2 – “Summary of Significant Accounting Policies” under the section titled “New Accounting Standards” in the Notes

to Consolidated Financial Statements for discussion of these adjustments.

(5) These amounts were affected by our 2006 restructuring program. For more information, please refer to our Consolidated

Financial Statements and related Notes included in our 2006 Annual Report on Form 10-K.

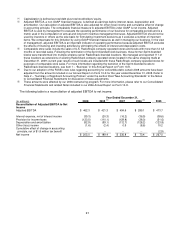

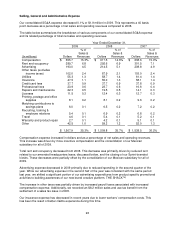

The following table is a reconciliation of adjusted EBITDA to net income.

Year Ended December 31,

(In millions) 2009

2008 (4) 2007

2006 (5) 2005

Reconciliation of Adjusted EBITDA to Net

Income

Adjusted EBITDA $ 462.3 $ 421.3 $ 494.6 $ 285.1 $ 473.7

Interest expense, net of interest income (39.3) (20.3) (16.2) (36.9) (38.6)

Provision for income taxes (123.5) (110.1) (129.8) (38.0) (51.6)

Depreciation and amortization (92.9) (99.1) (112.7) (128.2) (123.8)

Other (loss) income (1.6) (2.4) 0.9 (8.6) 10.2

Cumulative effect of change in accounting

principle, net of $1.8 million tax benefit

--

--

--

--

(2.9)

Net income $ 205.0 $ 189.4 $ 236.8 $ 73.4 $ 267.0