Radio Shack 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

due to our counter-parties’ nonperformance. We do not hold or issue derivative financial instruments for

trading or speculative purposes. To qualify for hedge accounting, derivatives must meet defined

correlation and effectiveness criteria, be designated as a hedge and result in cash flows and financial

statement effects that substantially offset those of the position being hedged.

Foreign Currency Translation: The functional currency of substantially all operations outside the U.S. is

the applicable local currency. Translation gains or losses related to net assets located outside the United

States are included as a component of accumulated other comprehensive (loss) income and are classified

in the stockholders’ equity section of the accompanying Consolidated Balance Sheets.

Reclassifications: Certain amounts in the December 31, 2008 and 2007, financial statements have been

reclassified to conform with the December 31, 2009, presentation. These reclassifications had no effect on

net income or total stockholders’ equity as previously reported.

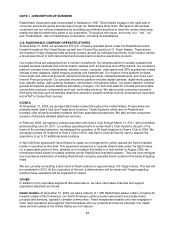

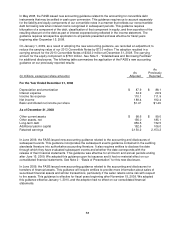

New Accounting Standards: In September 2006, the Financial Accounting Standards Board (“FASB”)

issued new accounting guidance related to fair value measurements and related disclosures. This new

guidance defines fair value, establishes a framework for measuring fair value, and expands disclosures

about fair value measurements. We adopted this new guidance on January 1, 2008, as required, for our

financial assets and financial liabilities. However, the FASB deferred the effective date of this new

guidance for one year as it relates to fair value measurement requirements for nonfinancial assets and

nonfinancial liabilities that are not recognized or disclosed at fair value on a recurring basis. We adopted

these remaining provisions effective January 1, 2009. The adoption of this accounting guidance did not

have a material effect on our consolidated financial statements.

In December 2007, the FASB issued new accounting guidance related to the accounting for business

combinations and related disclosures. This new guidance addresses the recognition and accounting for

identifiable assets acquired, liabilities assumed, and noncontrolling interests in business combinations.

The guidance also establishes expanded disclosure requirements for business combinations. The

guidance was effective for us on January 1, 2009, and we will apply this new guidance prospectively to all

business combinations subsequent to the effective date.

In December 2007, the FASB issued new accounting guidance related to the accounting for

noncontrolling interests in consolidated financial statements. This guidance establishes accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. This guidance requires that noncontrolling interests in subsidiaries be reported in the equity

section of the controlling company’s balance sheet. It also changes the manner in which the net income

of the subsidiary is reported and disclosed in the controlling company’s income statement. This guidance

was effective for fiscal years beginning after December 15, 2008. We adopted this guidance effective

January 1, 2009, and it had no effect on our consolidated financial statements.

In March 2008, the FASB issued new accounting guidance related to disclosures about derivative

instruments and hedging activities. This guidance amends and expands disclosure requirements to provide

a better understanding of how and why an entity uses derivative instruments, how derivative instruments

and related hedged items are accounted for, and their effect on an entity’s financial position, financial

performance, and cash flows. This guidance was effective for fiscal years beginning after November 15,

2008. We adopted this guidance effective January 1, 2009, and have applied its requirements on a

prospective basis. Accordingly, disclosures related to periods prior to the date of adoption have not been

presented. See Note 11 - “Derivative Financial Instruments” for these new disclosures.