Radio Shack 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

2009 COMPARED WITH 2008

U.S. RadioShack Company-Operated Stores Segment

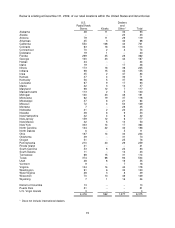

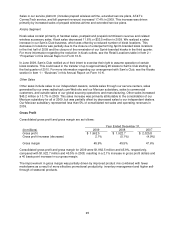

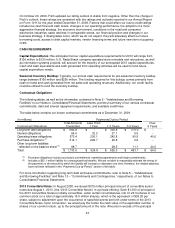

The following table provides a summary of our net sales and operating revenues by platform and as a

percent of net sales and operating revenues for the U.S. RadioShack company-operated stores segment.

Net Sales and Operating Revenues

Year Ended December 31,

(In millions) 2009 2008 2007

Wireless $ 1,342.1 36.8% $ 1,070.7 29.7% $ 1,085.6 29.8%

Accessory 968.6 26.5 1,085.0 30.0 941.1 25.9

Modern home 471.8 12.9 462.6 12.8 494.5 13.6

Personal electronics 384.7 10.5 492.3 13.6 596.6 16.4

Power 204.7 5.6 227.3 6.3 235.8 6.5

Technical 167.3 4.6 170.9 4.7 173.3 4.7

Service 109.3 3.0 93.1 2.6 97.2 2.7

Other 2.4 0.1 9.2 0.3 13.6 0.4

Net sales and operating

revenues

$ 3,650.9

100.0%

$ 3,611.1

100.0%

$ 3,637.7

100.0%

Sales in our wireless platform (includes postpaid and prepaid wireless handsets, commissions, residual

income and communication devices such as scanners and GPS products) increased 25.3% in 2009. This

sales increase was driven by increased sales in our Sprint Nextel postpaid wireless business, the addition

of T-Mobile as a postpaid wireless carrier, and increased sales of prepaid wireless handsets. These

increases were partially offset by decreased sales of GPS products.

Sales in our accessory platform (includes home entertainment, wireless, music, computer, video game

and GPS accessories; media storage; power adapters; digital imaging products and headphones)

decreased 10.7% in 2009. This sales decrease was primarily driven by decreased sales in digital-to-

analog converter boxes, wireless accessories, imaging accessories, and media storage, but was partially

offset by increased sales of television antennas. Consolidated sales of converter boxes were $170.1

million and $204.8 million in 2009 and 2008, respectively. The decrease in converter box sales occurred

in the second half of the year after the transition to digital television occurred in June 2009. We expect

sales of converter boxes to be minimal in 2010.

Sales in our modern home platform (includes home audio and video end-products, personal computing

products, residential telephones, and Voice over Internet Protocol (“VoIP”) products) increased 2.0% in

2009. In this platform we recorded sales gains in netbooks, digital televisions, and VoIP products, which

were substantially offset by sales declines in laptops, residential telephones, and DVD players.

Sales in our personal electronics platform (includes digital cameras, digital music players, toys, satellite

radios, video gaming hardware, camcorders, and general radios) decreased 21.9% in 2009. This

decrease was driven primarily by sales declines in digital cameras, digital music players, video game

consoles, satellite radios, and toys.

Sales in our power platform (includes general and special purpose batteries and battery chargers)

decreased 9.9% in 2009. This decrease was primarily driven by decreased sales of both general and

special purpose batteries. Our sales performance in this platform was negatively affected by the

disruption during the transition process of the assortment to our Enercell brand. This transition process

will be complete in the first quarter of 2010.

Sales in our technical platform (includes wire and cable, connectivity products, components and tools,

and hobby products) decreased 2.1% in 2009. We recorded an increase in sales of wire and cable

products, which was more than offset by decreased sales across most of the other product categories in

this platform.