Radio Shack 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

Continuing Lease Obligations: We have obligations under retail leases for locations that we assigned to

other businesses. The majority of these lease obligations arose from leases for which CompUSA Inc.

(“CompUSA”) assumed responsibility as part of its purchase of our Computer City, Inc. subsidiary in

August 1998. Because the company that assumed responsibility for these leases has ceased operations,

we may be responsible for rent due under the leases.

Following an announcement by CompUSA in February 2007 of its intention to close as many as 126

stores and an announcement in December 2007 that it had been acquired by Gordon Brothers Group,

CompUSA’s stores ceased operations in January 2008. We may be responsible for rent due on a portion

of the leases that relate to the closed stores. As of February 8, 2010, we had been named as a defendant

in a total of 12 lawsuits from lessors seeking payment from us, six of which had been resolved.

Based on all available information pertaining to the status of these lawsuits, and after applying the

FASB’s accounting guidance on accounting for contingencies, the balance of our accrual for these

obligations was $6.2 million and $9.0 million at December 31, 2009 and 2008, respectively. We have

continued to monitor this situation and will update our accrual to reflect new information on outstanding

litigation and settlements as more information becomes available.

Purchase Obligations: We had purchase obligations of $314.1 million at December 31, 2009, which

include product commitments, marketing agreements and freight commitments. Of this amount, $292.7

million related to 2010.

NOTE 14 – CORPORATE AND FIELD HEADCOUNT REDUCTION

During the first quarter ended March 31, 2007, we recorded $8.5 million of pre-tax employee separation

charges in selling, general and administrative expense in connection with the termination of employment

of approximately 280 of our corporate support staff. We made cash payments to these individuals during

2008 and 2007 in the amounts of $1.9 million and $6.6 million, respectively. The reserve balance for

these separation charges was zero at both December 31, 2009 and 2008.

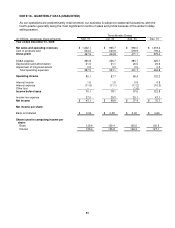

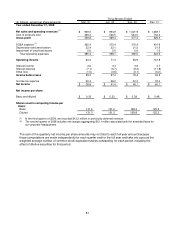

NOTE 15 - SEGMENT REPORTING

We have two reportable segments, U.S. RadioShack company-operated stores and kiosks. The U.S.

RadioShack company-operated store segment consists solely of our 4,476 U.S. company-operated retail

stores, all operating under the RadioShack brand name. Kiosks consist of our network of 562 kiosks,

primarily located in Sam’s Club and Target locations. In April 2009 we agreed with Sprint Nextel to cease

our arrangement to jointly operate the Sprint-branded kiosks in operation at that date. This agreement

allowed us to operate these kiosks under the Sprint name for a reasonable period of time, allowing us to

transition the kiosks to a new format. In August 2009, we transitioned these kiosks to multiple wireless

carrier RadioShack-branded locations. They are now managed and reported as extensions of existing

RadioShack company-operated stores located in the same shopping malls. Both of our reportable

segments engage in the sale of consumer electronics products; however, our kiosks primarily offer

wireless products and associated accessories. These reportable segments are managed separately due

to our kiosks’ narrow product offerings and performance relative to size.

We evaluate the performance of each reportable segment based on operating income, which is defined

as sales less cost of products sold and certain direct operating expenses, including labor, rent, and

occupancy costs. Asset balances by reportable segment have not been included in the segment table

below, as these are managed on a company-wide level and are not fully allocated to each segment for

management reporting purposes.