Radio Shack 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

The compensation cost charged against income for stock-based compensation plans was $12.1 million,

$12.8 million and $12.7 million in 2009, 2008 and 2007, respectively. The total income tax benefit

recognized for these stock-based compensation plans was $3.9 million, $3.4 million and $2.6 million in

2009, 2008 and 2007, respectively.

The aggregate intrinsic value of options exercised under our stock option plans was $0.1 million, zero,

and $22.9 million for 2009, 2008 and 2007, respectively. The aggregate intrinsic value is the amount by

which the market price of our common stock on the date of exercise exceeded the exercise price of the

option.

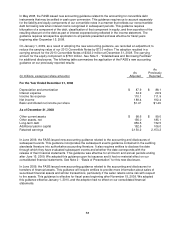

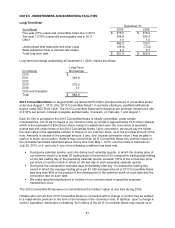

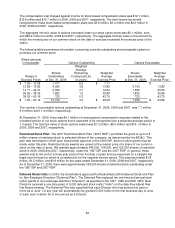

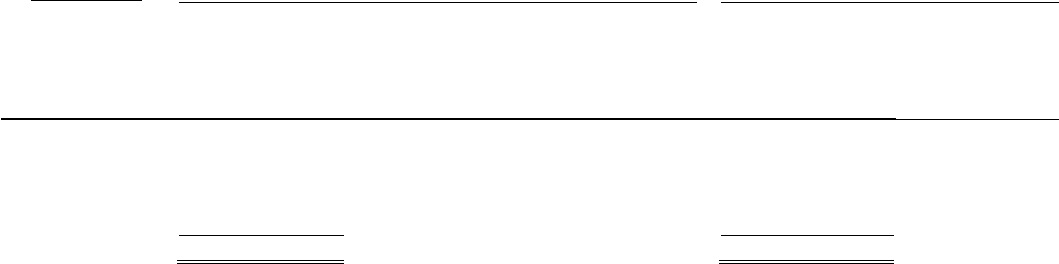

The following table summarizes information concerning currently outstanding and exercisable options to

purchase our common stock:

(Share amounts

in thousands)

Options Outstanding

Options Exercisable

Range of

Exercise Prices

Shares

Outstanding

at Dec. 31, 2009

Weighted

Average

Remaining

Contractual Life

(in years)

Weighted

Average

Exercise Price

Shares

Exercisable

at Dec. 31, 2009

Weighted

Average

Exercise Price

$ 7.05 – 13.58 1,417 6.2 $ 7.17 -- $ --

13.82 – 13.82 4,000 3.5 13.82 3,100 13.82

14.71 – 24.41 2,022 3.7 19.62 1,384 20.06

29.35 – 38.35 1,852 1.5 35.88 1,852 35.88

39.03 – 60.16 723 0.3 43.70 723 43.70

$ 7.05 – 60.16 10,014 3.3 $ 20.28 7,059 $ 23.89

The number of exercisable options outstanding at December 31, 2009, 2008 and 2007, was 7.1 million,

9.6 million and 11.4 million, respectively.

At December 31, 2009, there was $4.1 million of unrecognized compensation expense related to the

unvested portion of our stock options that is expected to be recognized over a weighted average period of

1.0 years. The total fair value of stock options vested was $7.2 million, $8.5 million and $14.1 million in

2009, 2008 and 2007, respectively.

Restricted Stock Plan: The 2007 Restricted Stock Plan (“2007 RSP”) permitted the grant of up to 0.5

million shares of restricted stock to selected officers of the company, as determined by the MD&C. This

plan was terminated in 2009 upon shareholder approval of the 2009 ISP, and no further grants may be

made under this plan. Restricted stock awards are valued at the market price of a share of our common

stock on the date of grant. We granted approximately 346,000, 158,000, and 122,500 shares of restricted

stock in 2009, 2008 and 2007, respectively, under the 1997 ISP and the 2007 RSP. In general, these

awards vest at the end of a three-year period from the date of grant and are expensed on a straight-line

basis over that period, which is considered to be the requisite service period. This expense totaled $1.8

million, $1.5 million, and $0.9 million for the years ended December 31, 2009, 2008 and 2007, respectively.

As of December 31, 2009, there were approximately 353,000 shares of restricted stock outstanding under

the 1997 ISP and 2007 RSP.

Deferred Stock Units: In 2004, the stockholders approved the RadioShack 2004 Deferred Stock Unit Plan

for Non-Employee Directors (“Deferred Plan”). The Deferred Plan replaced the one-time and annual stock

option grants to non-employee directors (“Directors”) as specified in the 1997, 1999 and 2001 ISPs. New

Directors received a one-time grant of 5,000 deferred stock units (“Units”) on the date they attend their

first Board meeting. The Deferred Plan also specified that each Director who has served one year or

more as of June 1 of any year will automatically be granted 3,500 Units on the first business day of June

of each year in which he or she serves as a Director.